My end-of-week morning train WFH reads:

• Revisiting “Intelligence Drift” Why AI models still feel like they’re getting dumber. Anecdotal but widespread experience of LLMs seeming great at first, then getting progressively “dumber” over time. With models like GPT-4 and Claude 3.5 Sonnet, users reported worse answers, incomplete responses, and outright refusals to work. (Artificial Ignorance)

• Your Emotions Can Throw You Off Your Investing Game. A Vanguard Pro Explains How. The head of investor research at the fund giant outlines how early market experiences can shape investors’ risk tolerance. (Barron’s) see also Staying Focused Through Volatility: The Long-Term Case for this Bull Market: All these factors suggest that we’re still in a multi-year growth phase. Is this an opportunity to create “generational wealth?” Will AI create more millionaires in 5 years than the internet did in 20? Stay focused on the strongest growth stocks, stay focused on the bigger picture, but also take profits along the way. (Joe Fahmy)

• What the graduate unemployment story gets wrong: People with a degree are faring better, not worse than their non-graduate counterparts. (Financial Times)

• Why a Traditional Investment Portfolio is Better than Real Estate: If you want to invest in real estate because you want passive income, keep this in mind: There is no kind of investing that produces income more passively than a traditional investment portfolio. (Flow Financial)

• The 25 Most Interesting Ideas I’ve Found in 2025 (So Far): Charts and history lessons—across culture, politics, AI, economics, health, science, and the long story of progress. (Derek Thompson)

• It’s the Internet, Stupid: What caused the global populist wave? Blame the screens. (Persuasion)

• The Very Hungry Microbes That Could, Just Maybe, Cool the Planet: They feast on bubbles of methane seeping out of the ocean floor. Could their appetites be harnessed to slow climate change? (New York Times)

• Everybody Around Trump Hates the Unhinged Laura Loomer. Except Trump. She has zero qualifications, zero experience, zero talent except self-promotion. So how’d she get the national security adviser fired? (New Republic)

• They Call it ‘Magic Brew’—and It Makes MLB Stars Play Like They’re Completely Hammered: When opposing teams face the Brewers, something weird happens: highly-paid professionals seemingly forget how to throw and catch the ball. (Wall Street Journal)

• The Astonishing Versatility of Diane Keaton: Keaton wasn’t just a gifted performer; she also proved to be a fine director. She took wonderful photographs. She could sing, in a fine, clear voice with the charm of a robin’s warble. She adopted children in her early 50s. She never married. She always looked great, expressing radical, rapturous individuality with her clothing, her eyewear, her retro jewelry. But most significantly, she was one of the most sparkling actors of her generation, and though many people associate her mostly with the brainy doodle of a performance she gave in Annie Hall—a brilliant one—she was astonishingly versatile. (Time)

Be sure to check out our Masters in Business interview this weekend with Henry Ward, CEO and co-founder of Carta. The firm works with more than 50,000 companies, 8,500 investment funds, and 2.5+ million equity holders to manage capitalization tables, compensation, valuations, and liquidity, tracking over $2.5 trillion in company equity.

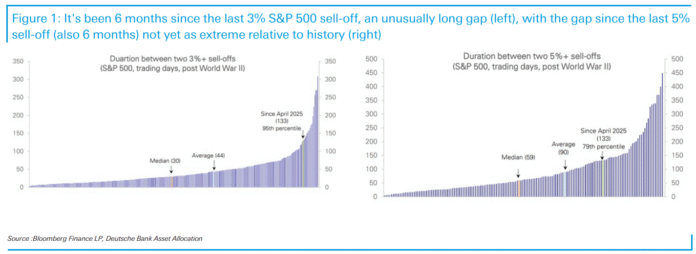

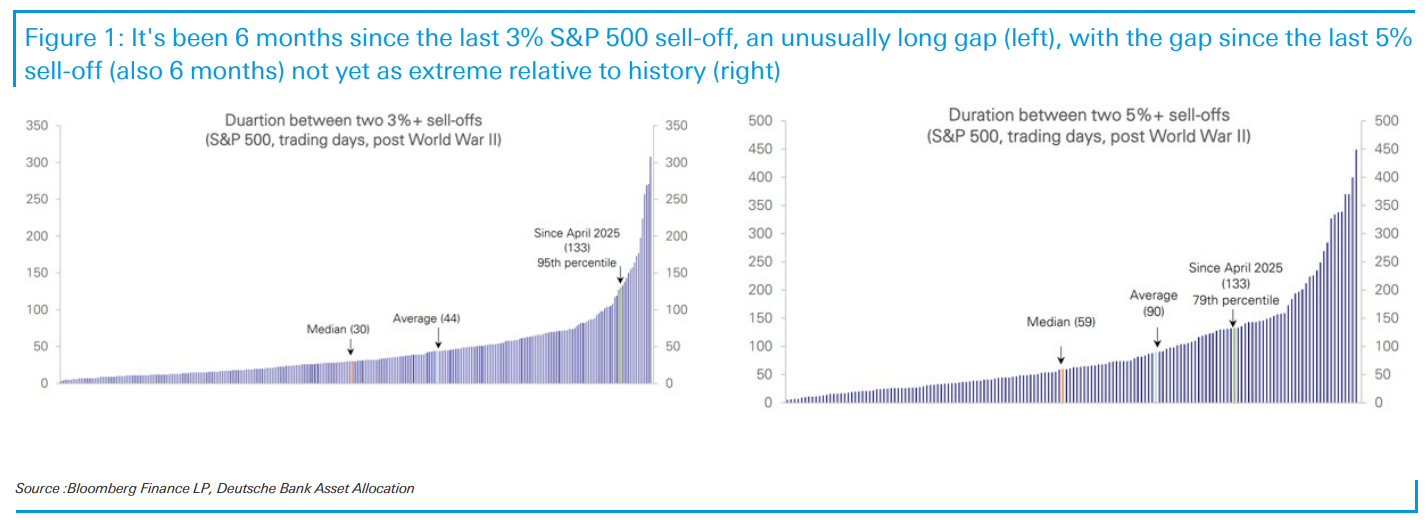

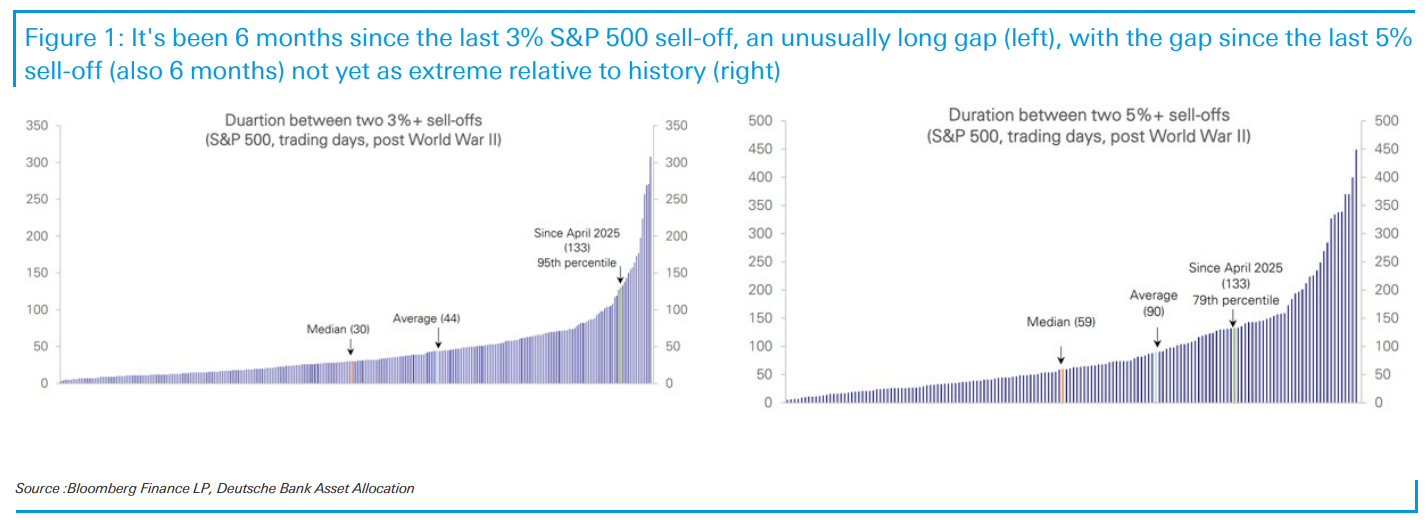

3% pullbacks occur every 1-2 months on average and 5% ones every 3-4 months. We’re currently at 6 months. There have been 14 longer runs since WWII without a 3% sell-off.

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.

Source link