Looking at the stock market over the past decade, you’ll see that many top-performing stocks have been tech companies. Recent developments have made tech stocks highly attractive and driven their valuations up — so much so that seven of the world’s 10 most valuable companies are in the tech sector.

Regardless of how impressive many tech stocks’ gains have been, it’s important to remember the value of patience in investing. The focus should always be on the long term.

While the past decade has been lucrative for many investors in tech stocks, the next decade could be just as promising. The following three companies are ones investors should consider buying and holding for the next decade. There will certainly be bumps along the way, but there’s a good chance you’ll look back and be glad you invested in them now.

1. Snowflake

Snowflake (NYSE: SNOW) operates a cloud-based data platform that allows users to aggregate, analyze, and share data across various platforms. Investors had lots of high expectations for the company around the time of its initial public offering (IPO), but since then, it has been a story of highs and lows.

In its fiscal 2025 first quarter (which ended April 30), Snowflake generated $829 million in revenue, which beat the consensus estimate. However, the company came up short of earnings estimates, and the stock continued the slide that began in March.

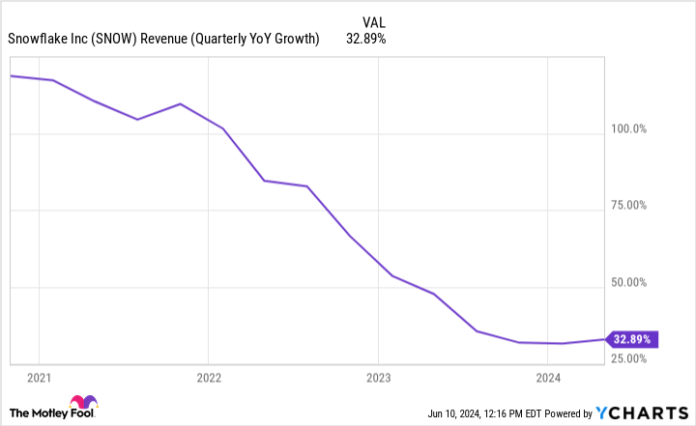

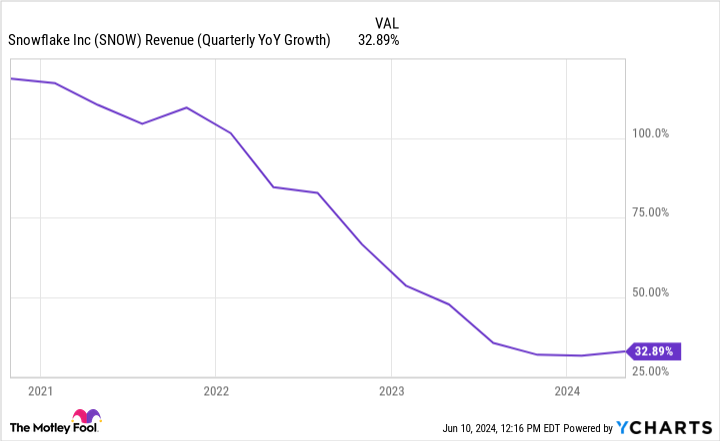

Yes, Snowflake’s year-over-year revenue growth has slowed, but its remaining performance obligation — revenue it can expect under existing contracts — is up 46% from last year to $5 billion, and management noted that after a period when some were hesitating to do so, more of its customers are beginning to make longer-term commitments.

Snowflake noted on its last earnings call that it expects margins to decline in the next year as it spends significantly on new graphics processing units (GPU) to support its AI initiatives, but that appears to be a necessary investment in infrastructure for it to achieve what it calls “meaningful revenue generation” in the next few years.

Like many other tech companies, Snowflake is betting big on AI and hoping to drive growth and bolster its offerings through the emerging technology. Add that to the projected growth of the big data industry, and Snowflake’s long-term value proposition becomes intriguing, especially considering its valuation is now close to the lowest it has been since its IPO.

2. CrowdStrike

There are many benefits to the world becoming more digitally connected, but one notable downside is that it increases the opportunities for hackers to conduct cyberattacks. The global annual cost of cyberattacks in 2017 was around $700 billion. According to a forecast by the researchers at Statista, by 2028, that annual cost will be over $13.8 trillion. That’s where CrowdStrike (NASDAQ: CRWD), one of the world’s premier cybersecurity companies, comes into the picture.

CrowdStrike was one of the pioneers of AI-native cybersecurity solutions and has quickly become a go-to provider for many of the world’s top companies, including 62 members of the Fortune 100. Although AI has attracted mainstream attention in the past couple of years, CrowdStrike has been using it for its security solutions from the beginning, giving it a data advantage over other cybersecurity companies that came later to the AI party.

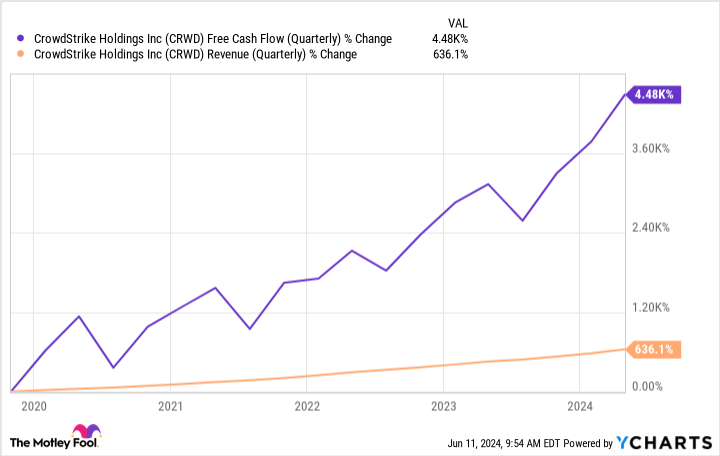

The effectiveness of CrowdStrike’s platforms can be seen in its customer growth and retention. Around 65% of its customers use five or more of its modules (software designed for a specific function), 44% use six or more, 28% use seven or more, and the number of deals involving eight or more modules grew by 95% year over year last quarter. This has also propelled CrowdStrike’s financials.

Cybersecurity is now a non-negotiable expense for many businesses globally, and the number should only increase. With a price-to-sales ratio of around 23.5, CrowdStrike trades at a premium to its peers, but for investors who have time on their side, its growth rate and growth opportunities make that a justifiable premium to pay.

3. Microsoft

Having been around for decades, Microsoft (NASDAQ: MSFT) stands out from the other two companies on this list, but even as the world’s most valuable public company, it still has a lot of room for growth.

One key reason to hold onto Microsoft’s stock for the next decade is the way the company is intertwined with the global business world.

Think about all the products and services that Microsoft offers that many businesses rely on in their daily operations — Office products (Excel, Word, Outlook, Teams, etc.), Azure, Windows, and dozens of other enterprise solutions.

Its position as a core supplier of services to the global business world insulates Microsoft from the impacts of economic downturns compared to many of its tech counterparts and gives it long-term stability. When economic conditions are less than ideal, it’s much easier to delay upgrading devices or cut back on advertising than it is to cancel your cloud service, stop using essential productivity tools, or do without IT infrastructure support.

Microsoft’s importance to the global business world ensures it will be a dominant player in the tech space for some time.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $802,591!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Stefon Walters has positions in Microsoft. The Motley Fool has positions in and recommends CrowdStrike, Microsoft, and Snowflake. The Motley Fool has a disclosure policy.

3 Tech Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool

Source link