(Bloomberg) — A recovery of global shares continued in Asia, tracking gains on Wall Street following signs of resilience in the US labor market and improved consumption in China.

Most Read from Bloomberg

Stocks rose across the region from Japan to South Korea and Australia. Chinese equities advanced after data showed the country’s inflation rose more than expected, offering hope of a recovery in domestic demand. Markets are closed in Singapore.

US stock futures gained in Asia, following a rally on Wall Street Thursday. The S&P 500 had its best day since November 2022, while the Nasdaq advanced 3.1%.

Investor mood improved after a better US jobless claims report that alleviated fears of a recession triggered by last week’s worse-than-expected employment data. The focus will now shift toward a fresh slew of US economic indicators due next week, including consumer prices.

An improved growth outlook for China also bodes well for risk appetite.

“China can actually be outperforming when other markets are so volatile,” Aisa Ogoshi, a fund manager at JPMorgan Asset Management Japan Ltd., told Bloomberg TV. “Policy tailwinds in the country are starting to appear.”

It remains to be seen how long the latest rebound can last as investors continue to digest different signals from policymakers. For one, Federal Reserve Bank of Kansas City President Jeffrey Schmid indicated he’s not ready to support a reduction in interest rates with inflation above the target, according to comments made on Thursday in the US.

In Japan, shares in Tokyo Electron Ltd. jumped after the company lifted its profit forecast for the fiscal year to March and reported a better-than-expected surge in sales.

The yen weakened slightly against the dollar Friday, on pace for its fourth day of depreciation against the greenback.

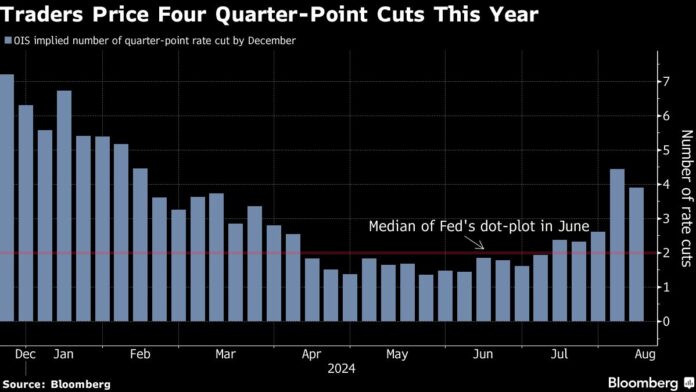

Treasuries were steady in Asian trading after declines across the curve Thursday. Swap traders further trimmed bets on aggressive Fed easing in 2024. Cryptocurrencies surged, with investors returning to riskier assets across financial markets.

The global repricing has been so sharp that at one point interest-rate swaps implied a 60% chance of an emergency rate cut by the Fed in the coming week — well before its next scheduled meeting in September. Current pricing suggests about 40 basis points of cuts for September.

Oil rose slightly following a Thursday rally, against the backdrop of simmering tensions in the Middle East. Gold slid.

Meanwhile, steel and aluminum producers in Canada were urging Prime Minister Justin Trudeau’s government to swiftly impose new tariffs on Chinese products, saying metals from the Asian powerhouse are flooding the Canadian market and threatening local jobs.

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 12:06 p.m. Tokyo time

-

Nasdaq 100 futures rose 0.3%

-

Japan’s Topix rose 1.5%

-

Australia’s S&P/ASX 200 rose 1.5%

-

Hong Kong’s Hang Seng rose 2%

-

The Shanghai Composite rose 0.3%

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro was little changed at $1.0921

-

The Japanese yen fell 0.1% to 147.44 per dollar

-

The offshore yuan rose 0.1% to 7.1768 per dollar

Cryptocurrencies

-

Bitcoin rose 3% to $61,323.31

-

Ether rose 4.2% to $2,678.57

Bonds

Commodities

-

West Texas Intermediate crude rose 0.3% to $76.39 a barrel

-

Spot gold fell 0.2% to $2,423.15 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link