tadamichi

Wall Street lore presumes that September is the worst month for stocks. Piper Sandler decided to look at whether data bears that out, and if it does, whether it extends to banks, as well.

The firm looked back at the last 25 years and calculated the percentage of positive months for each month of the year for the S&P 500 Index (SPX). Indeed, September had the lowest percentage, showing gains 46% of the time, Mark Fitzgibbon, head of FSG Research at Piper wrote in a recent note to clients. November had the highest, seeing gains 75% of the time.

Then he looked to see if the September Effect applies to bank stocks. “To our surprise, the results were a bit different from the broader market,” he wrote in a note to clients. For the S&P 500 Bank Index (SP500-401010), June was the worst month, logging gains only 32% of the time. The best month for bank stock performance was July, which recorded gains 76% of the time. September was the eighth best, or fifth worst, month of the year for that group of stocks.

For smaller bank stocks, as measured using the Nasdaq Bank Index (BKX), January and June tied for the worst-performing months and September notched the eighth-best performance. The best-performing month for that gauge was November.

Piper Sandler rates the following banks as Underweight: Bank of Hawaii (NYSE:BOH), Cathay General Bancorp (NASDAQ:CATY), Huntington Bancshares (NASDAQ:HBAN), Northwest Bancshares (NASDAQ:NWBI), Simmons First National (NASDAQ:SFNC), and Washington Trust Bancorp (NASDAQ:WASH).

Among diversified and regional banks, the SA Quant ratings system ranks New York Community Bancorp (NYSE:NYCB), Triumph Financial (NASDAQ:TFIN), Flushing Financial (NASDAQ:FFIC), Midland States Bancorp (NASDAQ:MSBI), and Eagle Bancorp (NASDAQ:EGBN) with the five lowest ratings.

The SA Quant system’s top bank picks include Bank of America (BAC), First Citizens BancShares (FCNCA), East West Bancorp (EWBC), and Wells Fargo (WFC), and Fulton Financial (FULT).

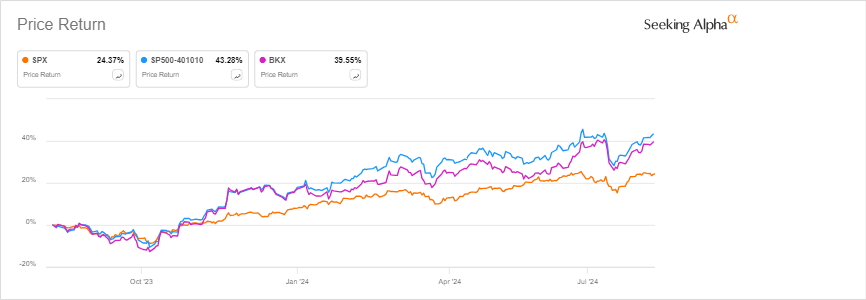

Note that in the past year, the S&P 500 Bank Index climbed 42% and the Nasdaq Bank Index increased 40%, outpacing the S&P 500’s 24% rise.

More on Midland States, Bank of Hawaii, etc.

Source link