Oops, please come back.

BLS Notice

BLS will publish the September 2025 Consumer Price Index (CPI) on Friday, October 24, 2025, at 8:30 A.M. Eastern Time. No other releases will be rescheduled or produced until the resumption of regular government services. This release allows the Social Security Administration to meet statutory deadlines necessary to ensure the accurate and timely payment of benefits.

The above from a BLS Website Notice

Quick CPI Summary

- The Trump administration is recalling furloughed workers to publish the September consumer-price index, which is used for various government services.

- The Social Security Cost of Living Adjustment (COLA) for 2026 relies in part on September CPI data.

- September inflation data also affects Treasury inflation-protected securities, and I bonds.

- The Fed uses CPI data in its determination of monetary policy

Social Security COLAs

The Wall Street Journal comments Why the Next CPI Report Is Important for Social Security Checks, Bonds and 401(k)s

Social Security

Under normal circumstances, retirees would learn next week how much bigger their Social Security checks for 2026 would be. That is because the annual raise is tied to the average inflation data for July, August and September, and announced soon after the release of the September report.

The Social Security cost-of-living adjustment, or COLA, is required to be published by Nov. 1. The BLS said Friday that the later October release of the CPI report allows the Social Security Administration to meet statutory deadlines necessary to ensure the accurate and timely payment of benefits.

The nonprofit Center on Budget and Policy Priorities estimates, based on data through August, a 2.8% Social Security COLA for next year, up from this year’s 2.5% raise. But a surprise in the CPI data for September could meaningfully raise or lower that estimate.

I bonds, TIPS

The Treasury Department issues two types of bonds that are indexed for inflation: Treasury inflation-protected securities, or TIPS, and the savings bonds known as I bonds.

Investors in both might have ended up slightly worse without the September CPI report, though most wouldn’t notice a big change in what the bonds pay out. That is because interest on the bonds would be based on an estimate for September inflation, rather than the actual number.

TIPS have a principal that adjusts based on the change in consumer prices, and a fixed interest rate that is applied to that principal. Those adjustments are typically announced for the coming month around the time that the CPI report for the previous month is released.

If September inflation data hadn’t been released by the end of October, regulations say the Treasury Department must come up with a substitute number based on the assumption that prices rose at the same pace as over the previous 12 months.

401(k) and IRA contribution limits

The IRS typically announces 401(k) and IRA contribution limits for the following year in the fall, based in part on the September inflation data. Those caps were also set to be delayed without the report.

In 2025, individuals under 50 can contribute up to $23,500 to their 401(k)s and similar plans. Those 50 and older can kick-in an extra $7,500 in catch-up contributions, an allowance that rises to $11,250 for people 60 to 63.

For IRAs, the current limit is $7,000, rising to $8,000 for people 50 and older.

Actuarial firm Milliman estimates the 2026 limits for 401(k)s will be $24,500, rising to $32,500 for those 50 and older and $35,750 for those 60 to 63.

Please Come Back

I happen to have a musical tribute.

House Speaker Mike Johnson Supports This Message

“There are programs that probably should be eliminated, but we want federal employees to be protected,” said House Speaker Mike Johnson (R., La.) on NBC News.

September CPI Year-Over-Year Guess

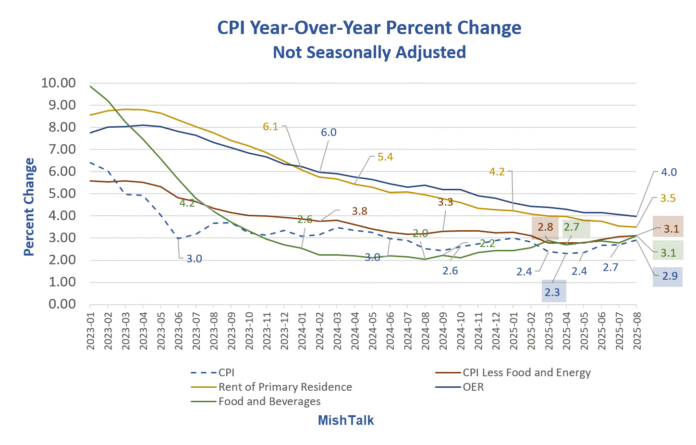

One of the key determinants of year-over-year CPI is what happened to the month-over-month CPI a year ago.

Last month, I calculated the September 2024 CPI to two decimal places at 0.23 percent.

Barring revisions, a month-over-month CPI over 0.23 percent would cause the year-over-year CPI to rise. If lower, the year-over-year CPI would drop.

0.23 is a middle of the road number. Something like 0.00 for September of 2024 would have me thinking the year-over-year number would rise in September 2025.

Barring revisions, the year-over-year change for September 2025 rates to be unchanged from August +- 0.1 percentage point.

To two decimal places, I have year-over year CPI for August at 2.92 percent.

Look for ~2.9 percent this year, up from 2.5 percent from last year.

Related Posts

September 11, 2025: CPI Provides No Reason for Fed to Cut Interest Rates, It Will Anyway

The CPI was higher than expected in August, but the Fed will do what it wants to do.

October 7, 2025: How Screwed Up Are BLS Real and Nominal Median Earnings?

Discrepancies between ADP and the BLS are vast. Let’s start with the BLS.

Is Homeowners Insurance Understated in the CPI?

I discussed homeowners insurance on August 11, 2025 in Is Homeowners Insurance Understated in the CPI? Shop Around!

Our Insurance went up by $2,000. Then another $2,000. Here’s our story.

Also consider Where Do You Spend Money on Food? How Screwed Up Are the BLS Weights?

Does the BLS match your budget?

Don’t worry, Trump says “There is virtually no inflation.”

Source link