Yes, regarding India and Japan. Germany is close.

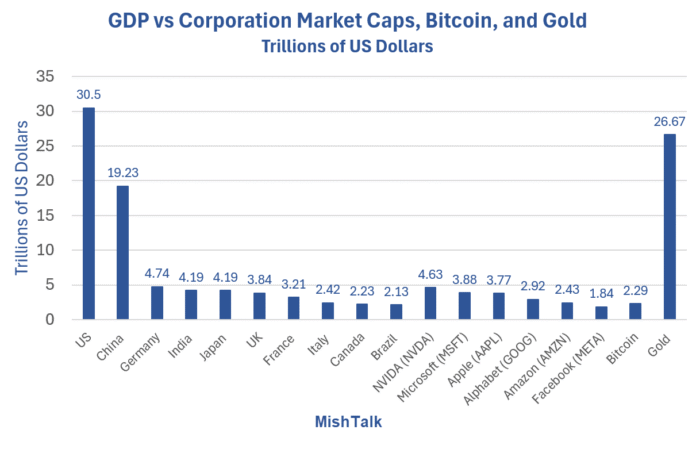

Top 10 Global GDPs in Trillions of US Dollars

- US: 30.5

- China: 19.23

- Germany: 4.74

- India: 4.19

- Japan: 4.19

- UK: 3.84

- France: 3.21

- Italy: 2.42

- Canada: 2.23

- Brazil: 2.13

Top Market Caps in Trillions of US Dollars

- Nvidia (NVDA): 4.63

- Microsoft (MSFT): 3.88

- Apple (AAPL): 3.77

- Alphabet (GOOG): 2.92

- Amazon (AMZN): 2.43

Gold and Bitcoin Market Caps in Trillions of US Dollars

- Gold: 26.67

- Bitcoin: 2.29

Sources

Bubble? What Bubble?

This post was inspired by the Investing.com report What bubble? NVIDIA stock is ’born to run’ as analyst sets $7 trillion target

Cantor Fitzgerald analyst C.J. Muse raised his price target on the AI juggernaut to a Street-high $300 per share.

The new price target would represent a market value of $7.3 trillion for NVIDIA, which is already the most valuable company in the world at $4.7 trillion.

While AI bubble talk is rampant on Wall Street, Muse said emphatically, “This is not a bubble.” He said we are just in the early stages of the AI investment cycle.

“We are still in the early innings of a multi-trillion AI Infrastructure build-out with just the Hyperscalers providing significant line-of-sight into hundreds of billions of demand for the next handful of years, never mind other drivers such as Neo-Clouds, Enterprise, and Physical AI,” Muse stated.

Muse’s $7 trillion target for Nvidia would easily surpass the GDP of Germany at 4.7 trillion.

The Market Capitalization of Gold

Note: this section is from the above sources link to Gold.

The market cap of gold was obtained by multiplying the current gold price ($3,993 per ounce) with the world’s above ground gold reserves.

The amount of above ground reserves for Gold are estimated to be around 208,874 metric tonnes according to the World Gold Council (End-2021). Note that the estimated above the ground Gold reserves can vary by up to 20% from one source to another.

As a consequence it is safe to say that the the current Market Cap of Gold is between $21.453 Trillion and $32.180 Trillion.

Market Caps vs Countries

- Nvidia is worth more than the GDP of every country except the US, China, and Germany where it’s very close: 4.63 Nvidia vs. 4.74 Germany.

- Microsoft is worth more than every country’s GDP except the US, China, Germany, India, and Japan.

- Gold has an estimated market cap of 26.67 trillion, more than any country except the US.

- Bitcoin is comparable to Italy, Canada, or Brazil.

Gold Surges to New Record High

Gold vs. Faith in Central Banks Major Timeline

August 15, 1971: Nixon ended convertibility of gold at the then fixed price of $35.00 per ounce. Nixon’s actions allowed the Fed and Congress to inflate at will.

January 21, 1980: Gold spiked to a then high of $850 per ounce in the wake of Nixon shock.

March 1980: Volcker restored faith in central banks by jacking up interest rates to 20 percent. Volcker was followed by Alan Greenspan, labeled the “Great Maestro” for keeping inflation under control.

May 7, 1999: Brown’s Bottom! On the BOE announced plans to dump gold for other assets. Gold was $282. The notice drove the price to $252. The event is named after Gordon Brown, then the UK Chancellor of the Exchequer.

August 23, 2011: Gold hit a then record high of $1923 with a European debt Crisis.

July 26, 2012: ECB president Mario Draghi made his famous “Whatever it Takes” speech. “Within our mandate, the ECB will do whatever it takes to preserve the Euro, and believe me it will be enough.” What did Draghi do? Curiously, nothing at all. However, his statement calmed the bond markets and equity markets. Gold was clobbered.

December 17, 2015: Gold bottoms as faith in central banks peaks again.

What followed was QE to absurd levels, three rounds of massive free money fiscal stimulus during Covid, and the Fed misjudging the ensuing inflation.

Now we have insane tariff policy by Trump, a Fed that still does not understand inflation, and Trump pressure on the Fed to cut rates.

If that was not enough, US debt now grows by $1 trillion every 150 days.

On September 2, 2015, I noted Gold Surges Above $3,600 to New Record High Despite a Rising Dollar

Since then gold soared above $4,000 but is right at that level as I type.

Related Posts

June 21, 2025: Record Deficits as Far as the Eye Can See and Trump Begs for More

Let’s investigate CBO deficit projections vs what actually happened.

June 23, 2025: How Long Can the US Dollar Remain the Global Reserve Currency?

An article on the fundamental flaws with the euro triggered this post.

August 14, 2025: US Debt Now Grows by $1 Trillion Every 150 Days

US national debt just topped $37 trillion and is growing fast.

A Word About Faith

Note that the market cap of gold at 26.67 trillion is approaching US GDP at 30.5 trillion.

Gold does not believe the Fed is under control, Congress is under control, budget deficits are under control, or Trump is under control.

And neither do I.

Source link