At its latest FOMC meeting, the Fed discussed the ampleness of $6 trillion.

Increasing Definition of Ample

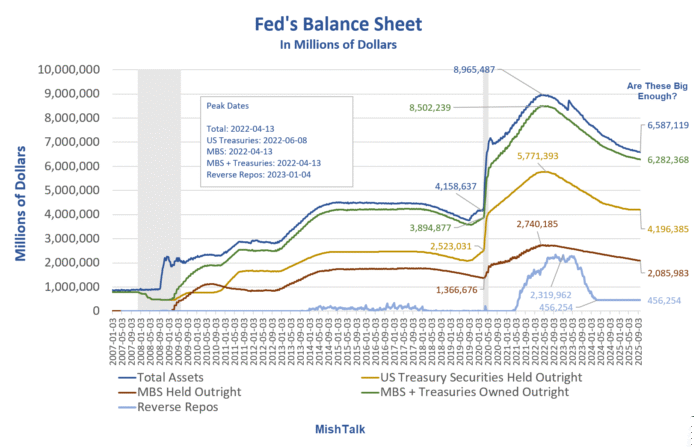

In January of 2007, prior to the Great Recession, the Fed’s total balance sheet was under $875 billion. And the Fed held no mortgage backed securities (MBS). That was considered ample.

January 2007 Ample

- Total: 0.9 Trillion

- US Treasuries: 0.8 Trillion

- MBS: 0.0 Trillion

In the wake of the Great Recession, the Fed embarked on multiple rounds of QE to artificially force down interest rates.

Then Fed Chair Ben Bernanke said the Fed would wind its balance sheet down. I commented that would never happen.

In multiple rounds of QE, the Fed’s balance sheet exploded.

Pre-Covid Panic Balance Sheet

- Total: 4.2 Trillion

- US Treasuries: 2.5 Trillion

- MBS: 1.4 Trillion.

That was the “new” ample. Now we are discussing a post-Covid measure of ample.

Quantitative Tightening

Since 2022, the Fed has been winding down its balance sheet in a process known as quantitative tightening.

Earlier this year, the Fed slowed the pace by reducing the amount of bond holdings it lets roll off every month.

Current Balance Sheet

- Total: 6.6 Trillion

- US Treasuries: 4.2 Trillion

- MBS: 2.1Trillion

Is that Ample?

Please consider Minutes of the Federal Open Market Committee September 16–17, 2025

Several participants remarked on issues related to the Federal Reserve’s balance sheet and implementation of monetary policy. A few participants stated that balance sheet reduction had proceeded smoothly thus far and that various indicators pointed to reserves remaining abundant. Nevertheless, with [bank] reserves declining and expected to decline further, they noted that it was important to continue to monitor money market conditions closely and evaluate how close reserves were to their ample level.

If balance sheet runoff were to continue at the current pace, the System Open Market Account (SOMA) portfolio was expected to decline to just over $6 trillion by the end of March.

Debate Over Balance Sheet Runoff Intensifies

Bloomberg reports Fed Minutes Show Debate Over Balance Sheet Runoff Intensifies

Several participants at the Federal Reserve’s September policy meeting said it was important to continue monitoring money-market conditions and evaluate how close bank reserves are to their “ample” level, as the central bank continues to unwind its massive portfolio of securities.

The remarks come as prolonged funding pressures in US money markets, just as bank reserves held at the Fed are dwindling, are suggesting the central bank may be getting closer to ending its balance sheet runoff.

As the Treasury has ramped up debt issuance to rebuild its cash balance following the increase in the debt ceiling in July, it’s draining liquidity from other liabilities on the Fed’s ledger, like the central bank’s overnight reverse repurchase agreement facility and bank reserves.

The flurry of Treasury bill issuance is dragging yields higher across a range of instruments. Interest-rate benchmarks tied to overnight repurchase agreements collateralized by US Treasuries are hovering around the Fed’s interest on reserve balances rate, known as IORB, an indication that higher funding costs are here to stay.

Meanwhile, bank reserves [not to be confused with the Fed’s balance sheet] have been steadily declining, falling below $3 trillion, the lowest level since January, according to the latest data.

Fed Chair Jerome Powell said last month bank reserve balances are still “abundant” and have yet to reach the minimum level needed to cushion against market disruptions, though he acknowledged they’re getting closer. Fed Governor Christopher Waller earlier estimated that level — known as ample — at $2.7 trillion.

Still, central bank officials appear divided on how much the Fed should tighten its balance sheet. Fed Vice Chair for Supervision Michelle Bowman said at the end of September the Fed should seek to achieve the smallest balance sheet possible, with reserve balances at a level closer to scarce than ample. That’s in contrast with Powell, Remache and others who have suggested that the runoff should end once reserves are near ample, likely by the end of this year

Functioning Levels

Apparently, the Fed now needs ~6 trillion on its balance sheet, and banks need ~3 trillion in reserves to function.

Bear in mind, the Fed reduced reserve requirements on consumer deposits to zero.

Policy Mistakes

Please see my post Fed Interest Rate and QE Policy Mistakes in Pictures and Silly Fed Comments

When you are clueless about inflation you cannot possibly get policy right. The tendency is to overshoot in both directions creating asset bubbles of increasing amplitude over time.

Free Money

The Fed is paying banks interest on reserves (about 3.3 trillion as of August) at the ongoing rate which is currently 4.1 percent.

4.1 percent of 3.3 trillion is 135,300,000,000. That’s $135 billion in free money annually to banks at taxpayer expense.

Is that ample or what?

This of course is not ample, but asinine. And it’s one of the reasons why I am openly campaigning to be the next Fed Chair.

I Officially Announce my Availability to Become the Next Fed Chair

Please consider my July 9, 2025 post I Officially Announce my Availability to Become the Next Fed Chair

Trump considers naming the next Fed Chair early. I have a fifteen-point plan.

Mish’s 15-Point Fed Plan

- Explain to the nation why we don’t need a Fed and how independent central banks have created boom-bust cycles of increasing amplitude over time. The main corollary is history shows the one thing worse than independent central banks is a central bank run by politicians, frequently ending in hyperinflation.

- Surround myself with qualified insiders who understand the Fed but also believe in the mission to end the Fed.

- Stop paying interest on reserves, phased in over 18 months.

- Wind down the Fed’s balance sheet totally in 2-3 years.

- Require that assets available on demand such as checking and savings accounts are truly available on demand. That means demand deposits are parked in overnight US treasuries. This would be phased in over two years. As a result, we would have genuine safekeeping banks.

Click on the preceding link for the rest of my plan. Essentially, I intend to wind down the Fed orderly, then fire myself.

Source link