The weekend is here! Pour yourself a mug of Danish Blend coffee, grab a seat outside, and get ready for our longer-form weekend reads:

• Inside the Credit Card Battle to Win America’s Richest Shoppers: The fierce fight between Amex and Chase is playing out over higher fees, extravagant events and every perk imaginable. (Bloomberg) free.

• How mega batteries are unlocking an energy revolution. These might look like shipping containers in the desert, but they are actually the key to unlocking a clean energy revolution. Across California, installations of mega batteries store power from renewable sources and distribute it when people need it most. The sun provides most of California’s electricity during the day. But it is a different story at night. Batteries provide the answer. (Financial Times) see also AI Data Centers, Desperate for Electricity, Are Building Their Own Power Plants: Bypassing the grid, at least temporarily, tech companies are creating an energy Wild West; ‘grab yourself a couple of turbines’. (Wall Street Journal)

• YouTube Just Ate TV. It’s Only Getting Started: In two decades, the app has grown from a user-generated circus into the most powerful platform on earth. CEO Neal Mohan on his $100 billion vision for YouTube’s future and the disruption it’s left in its wake. (The Hollywood Reporter)

• Hetty Green: The Witch of Wall Street: Hetty Green was the richest woman you’ve never heard of. In the late 1800s, she built a fortune worth billions today in a world designed to stop her. Women couldn’t vote, couldn’t own property, and weren’t even allowed on the stock exchange floor. (Farnam Street)

• The Rules of Investing Are Being Loosened. Could It Lead to the Next 1929? A group of financiers is trying to convince the public to invest heavily in private equity and crypto — a risky gambit with some real 1920s vibes. (New York Times) see also The Lesson of 1929: Debt is the almost singular through line behind every major financial crisis. (The Atlantic)

• Why Some Americans Don’t Invest in the Stock Market: While about half of Americans report owning stocks either personally or jointly with a household member, a substantial portion of the population remains without stock investments. Why don’t more people participate in the stock market? (Federal Reserve Bank of Philadelphia)

• Everything Is Television: A theory of culture and attention.(Derek Thompson) see also The last days of poptimism: The new stars are old-school cool (Unherd)

• A Chat with A. Lange & Söhne CEO Wilhelm Schmid about Numbers, Community, and Luxury Retail: From production insights to the ever-shifting landscape of luxury retail, Schmid offers a candid glimpse into the brand’s ethos and his personal odyssey as the leader of one of horology’s most esteemed names. (Watchonista)

• These 2 quick tests can tell you if you’re as fit as an 80-year-old elite athlete. Measure your strength, power and coordination with these two simple fitness checks. (Washington Post)

• Thousands Of Words About The Bearer Bonds In DIE HARD: You will learn things from this blog post! (Calm Down)

Be sure to check out our Masters in Business interview this weekend with Henry Ward, CEO and co-founder of Carta. The firm works with more than 50,000 companies, 8,500 investment funds, and 2.5+ million equity holders to manage capitalization tables, compensation, valuations, and liquidity, tracking over $2.5 trillion in company equity.

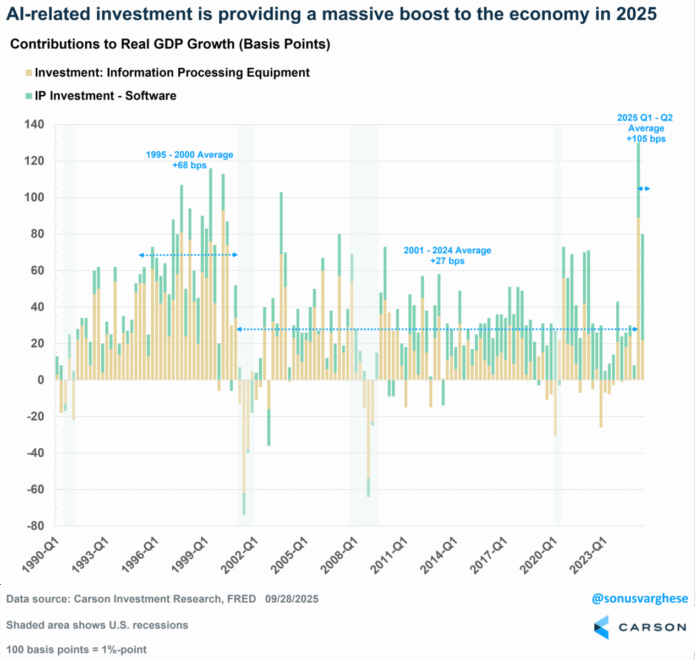

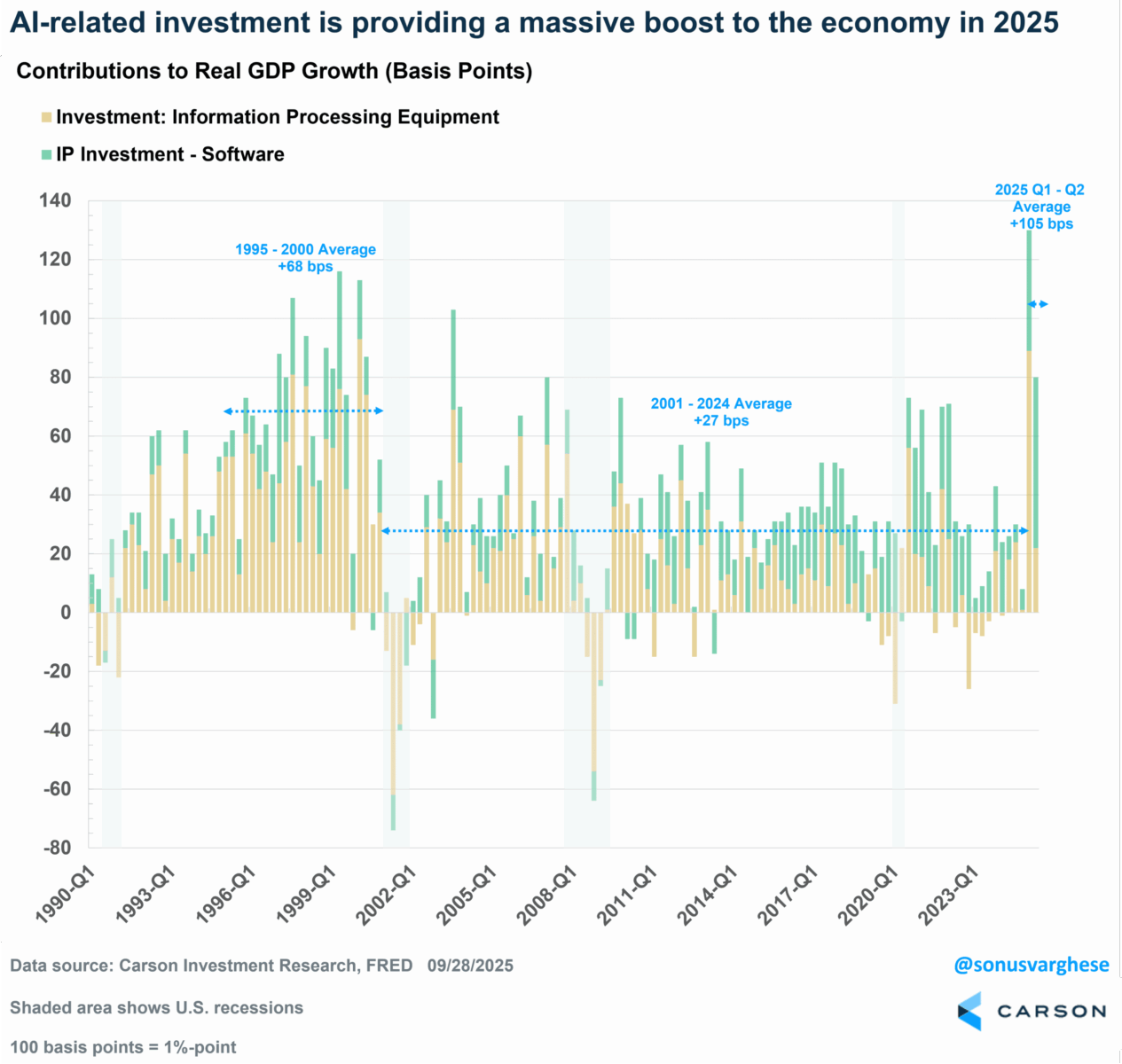

AI is already having a massive impact on the economy. Specifically, investment, i.e. spending on AI-related hardware and software

Source: Carson Group

Sign up for our reads-only mailing list here.

~~~~

To learn how these reads are assembled each day, please see this.

Source link