Current betting on Kalshi is for a 34.5 day shutdown (5pm CT), taking us to November 3-4. At this rate, of the NBER BCDC key variables, we will miss consumption and personal income, and the August manufacturing and trade industry sales releases, as well as the Q3 advance GDP release. We’ve already missed the employment situation and industrial production releases.

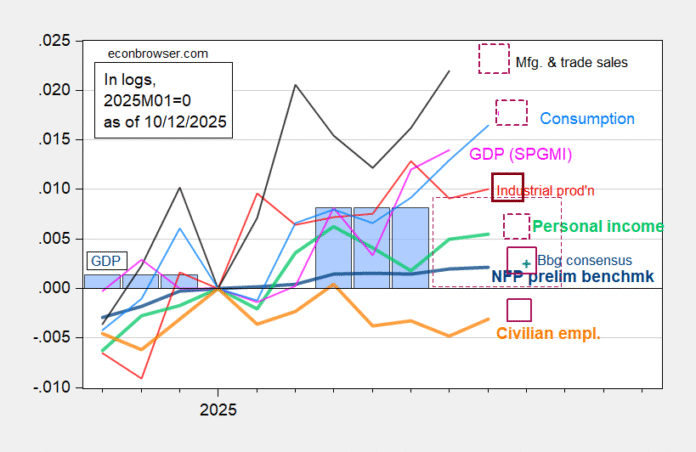

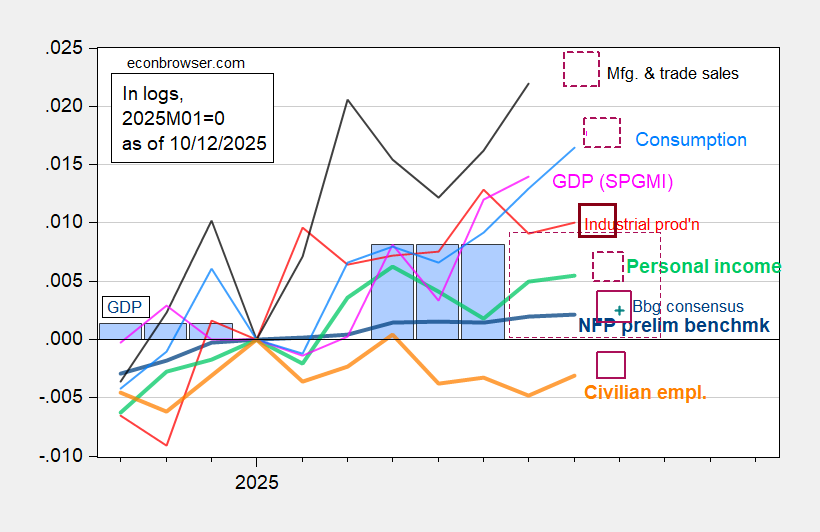

Figure 1: Implied NFP preliminary benchmark revision (bold blue), civilian employment with smoothed population controls (bold orange), industrial production (red), Bloomberg consensus employment for implied preliminary benchmark, (blue +), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2025M01=0. Purple squares denote releases already missed. Purple dashed squares indicate releases that will be missed and/or delayed with a 31 day shutdown. Source: BLS via FRED, Federal Reserve, BEA 2025Q3 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

One question is whether we will ever get the October employment situation release, given that interviews were to be undertaken this week, for last week’s reference period. Unlike the case of the CPI release, there’s been no stated recall workers to conduct the surveys for the employment situation release.

As noted on Marketplace, today, even when (if) the data comes out, all will not necessarily be well:

“And maybe look at those data with a little bit of skepticism, considering that it might not fully reflect the time that’s usually covered,” [the Conference Board’s] Zabinska-La Monica said.

And skepticism about the economic data can have consequences.

“If we don’t know what the quality of the data will be. Maybe it’s good, but maybe it’s not. Well, that’s uncertainty. That’s risky,” said Laura Veldkamp, a finance professor at Columbia University.

That can cause companies to freeze up.

“What firm wants to say, ‘Let’s engage in a risky and costly new investment project, that has uncertain rewards, in an environment where you don’t have clear information about what the current state of the economy is,’” said Veldkamp.

That’s why Veldkamp said unreliable data can take a toll on the broader economy.

Source link