Enbridge (NYSE: ENB) is not an exciting company, but that’s actually one of the biggest attractions here. That and an ultra-high dividend yield of around 7.4%. But to really appreciate why you’ll be glad you bought this stock in a few years, you need to take a deeper dive into its business and how it returns value to investors over time.

Enbridge is more than a midstream giant

The energy sector is known for being volatile, but not every company in the industry deserves that label. Upstream (drilling) and downstream (refining and chemicals) businesses are often quite volatile, but midstream businesses like Enbridge usually aren’t. That’s because midstream companies own the energy infrastructure (like pipelines) that connects the upstream to the downstream, and the rest of the world, and they largely charge fees for the use of their assets.

Enbridge is, basically, a toll taker. And since oil and natural gas are vital to the world functioning smoothly, demand tends to remain strong even when energy prices are weak. Oil pipelines account for around 50% of earnings before interest, taxes, depreciation, and amortization (EBITDA) while natural gas pipelines make up roughly 25%. Which is where the next interesting fact about Enbridge arises.

The rest of the energy giant’s business comes from regulated natural gas utilities (22% of EBITDA) and renewable power investments (3%). Natural gas is cleaner-burning than coal or oil and is seen as a transition fuel. Enbridge recently agreed to buy three natural gas utilities from Dominion Energy, which increased its exposure to this energy niche from 12% up to above 22%. Regulated utility assets are given a monopoly in the regions they serve in exchange for being required to get rates and investment plans approved by the government. That tends to lead to slow and steady growth over time. In short, Enbridge’s business is even more reliable thanks to this investment.

Then there’s the renewable power business, which is fairly small relative to the rest of the company. But then clean energy is still a relatively small piece of the global energy pie, too. The fact that Enbridge is expanding into the space is basically an attempt to use its carbon fuel profits to change along with the world as clean energy becomes more important over time. It represents a hedge, of sorts, for investors who aren’t ready to jump into renewable power but recognize its increasing role in the world.

What can investors expect from Enbridge?

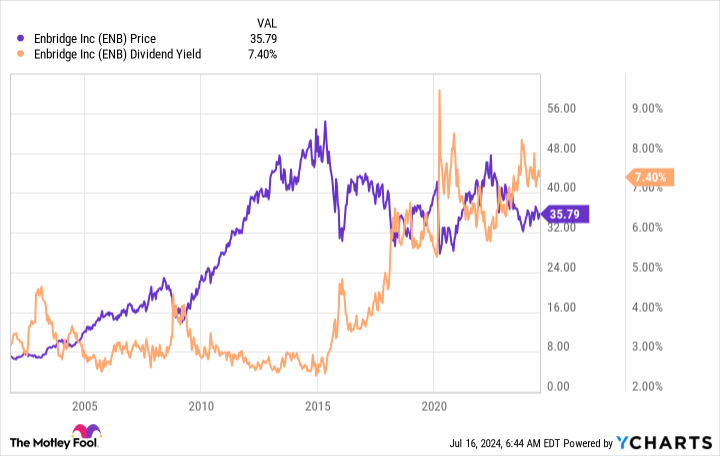

So Enbridge is a boring midstream company that’s slowly changing its business in a cleaner direction. That’s not exactly an exciting story until you take into consideration the huge 7.4% dividend yield. Most investors expect the stock market as a whole to provide returns of roughly 10% a year, so Enbridge’s dividend alone gets you roughly three-quarters of the way there.

That dividend, meanwhile, is backed by an investment-grade-rated balance sheet. And the distributable-cash-flow payout ratio is right in the middle of management’s 60%-to-70% target range. The dividend has also been increased annually for 29 consecutive years. This is a reliable dividend stock and there’s no reason to believe that the dividend is at risk. In fact, it seems highly likely that slow and steady dividend growth in the low single digits is a reasonable expectation.

So, if the dividend grows roughly in line with inflation, at about 3%, the total return investors can expect is probably about 10%, adding the current 7%-plus yield to the dividend increase of around 3%. Normally, stocks rise along with their dividends over time to keep the yield constant, so market-like returns from this high-yield stock isn’t an unrealistic expectation. That’s hard to complain about, particularly if you reinvest your dividends, which allows them to compound over time.

The base case for Enbridge is good

It seems likely that Enbridge can manage to just plod along doing what it is doing. That will be enough to provide solid returns to investors, as noted above. But what’s interesting here is that Enbridge’s dividend yield is historically high today. So it actually looks like it may be trading at a depressed price.

It is entirely possible that this situation doesn’t change and the yield has simply risen into a new range to reflect Enbridge’s business as it stands today. However, if Wall Street suddenly becomes more interested in the company, investors who buy today will get a boost from increased demand for the shares. The base case is for Enbridge’s boring business to produce roughly market-like returns while the upside could be much higher. That seems like an attractive risk/reward balance that you’ll be sorry you missed out on if you don’t jump aboard soon.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Reuben Gregg Brewer has positions in Dominion Energy and Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

A Few Years From Now, You’ll Wish You’d Bought This Undervalued High-Yield Stock was originally published by The Motley Fool

Source link