(Bloomberg) — Asian stocks advanced for a third session and the yen strengthened to a three-week high as the prospect of Federal Reserve interest rate cuts on the horizon stoked sentiment.

Most Read from Bloomberg

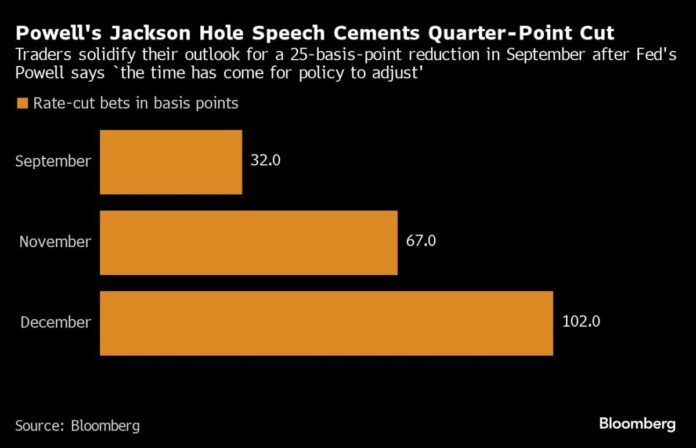

Shares in Australia and Hong Kong climbed on Monday, benefiting from Chair Jerome Powell’s Jackson Hole speech, when he said the “time has come” to pivot to monetary easing. The Fed’s dovish tilt also lifted the yen against the dollar, as Asian-domiciled funds added to existing short positions on the greenback. Japanese stocks declined due to the stronger local currency, while contracts for US equities were steady.

The positioning for lower US borrowing costs is rippling through financial markets, with global equities trading just shy of an all-time high, while the greenback is falling and investors are piling into sovereign debt. The yield on 10-year US Treasuries slipped one basis points to 3.79% on Monday.

“It should be risk-on,” said Chamath De Silva, head of fixed income at Betashares Holdings in Sydney. “Powell has confirmed that we’ll shortly be entering an easing cycle and that the fight against inflation is done, so I expect a bit of an everything rally, stocks and bonds both performing well.”

Haven buying in response to rising tensions in the Middle East was a driver in addition to the Fed wagers. Oil advanced 0.7% as the region braced for escalating conflict after an Israeli strike on Hezbollah targets in southern Lebanon.

The Bloomberg Asia Dollar Index kicked off the week by advancing to its highest since January. The Korean won climbed, while Singapore’s dollar advanced to its strongest in almost a decade as traders weighed the difference between the local monetary authority’s relatively hawkish policy outlook compared with that of the Fed.

Powell’s keenly awaited Jackson Hole speech constitutes a turning point in the Fed’s two-year battle to slow inflation, and means officials are likely to cut the benchmark interest rate from its highest in more than two decades. While the world’s largest economy is showing signs of cooling — warranting a pivot — there’s no sign yet of an outright contraction.

“My view is that the US is heading toward a soft landing” and Asian exports are doing well, said Khoon Goh, head of Asia research at ANZ Group Holdings Ltd. “I think we’re set to see a strong rally, rebound in Asian currencies during this Fed easing cycle.”

Elsewhere in Asia, the People’s Bank of China left the rate on its one-year policy loans, or the medium-term lending facility, at 2.3%, after a slashing the rate by 20 basis points in July. The PBOC has signaled that it’s de-emphasizing the medium-term lending facility’s role as a policy tool, while elevating the seven-day reverse repurchase rate to greater prominence.

The decision underscores Beijing’s cautious approach in supporting the economy, even as China reported a rare contraction in bank loans amid weak demand. The PBOC has been walking a fine line of stimulating growth and cooling a government-bond buying spree to limit financial risks in recent months.

Reflecting the lackluster performance of the economy, the CSI 300 Index of stocks slipped as much as 0.5% on Monday.

Authorities in China have also initiated stress tests with financial institutions on their bond investments, to make sure they can handle any market volatility should a record-breaking rally reverse, according to state-run media.

Meanwhile, gold steadied near a record high after Powell affirmed expectations of cuts. The precious metal has surged more than 20% this year in a blistering rally driven by Fed hopes, haven demand due to geopolitical risks, as well as buying from central banks and Asian consumers.

Key events this week:

-

Singapore industrial production, Monday

-

US durable goods, Monday

-

China industrial profits, Tuesday

-

Germany GDP, Tuesday

-

Hong Kong trade, Tuesday

-

Australia CPI, Wednesday,

-

Nvidia Corp. earnings, Wednesday

-

US GDP, Initial Jobless Claims Thursday

-

US personal income, spending, PCE price data, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 12:32 p.m. Tokyo time

-

Nikkei 225 futures (OSE) fell 1.1%

-

Japan’s Topix fell 1%

-

Australia’s S&P/ASX 200 rose 0.7%

-

Hong Kong’s Hang Seng rose 1%

-

The Shanghai Composite was little changed

-

Euro Stoxx 50 futures fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1184

-

The Japanese yen rose 0.3% to 143.99 per dollar

-

The offshore yuan was little changed at 7.1219 per dollar

-

The Australian dollar fell 0.2% to $0.6781

Cryptocurrencies

-

Bitcoin fell 0.3% to $64,082.95

-

Ether fell 1% to $2,742.94

Bonds

-

The yield on 10-year Treasuries declined one basis point to 3.79%

-

Japan’s 10-year yield declined 2.5 basis points to 0.875%

-

Australia’s 10-year yield declined four basis points to 3.88%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Georgina McKay.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link