N Rotteveel/iStock Editorial via Getty Images

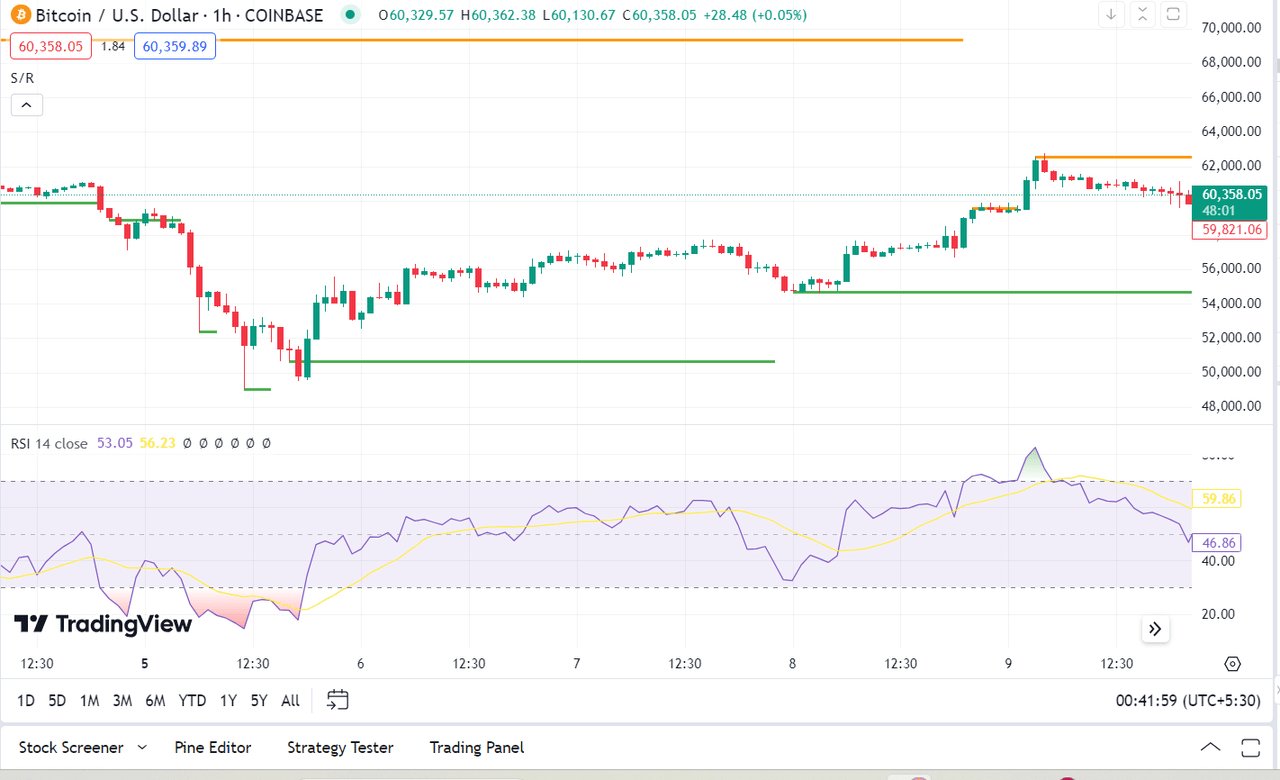

Bitcoin (BTC-USD) is expected to see a marginal fall of 1.9% in the week, after U.S. recession fears stoked a global selloff on Monday.

The world’s largest cryptocurrency crashed below the $50K mark at the start of the week, after a disappointing U.S. jobs report last week stoked fears that the U.S. economy is headed toward a recession. The concerns rattled global markets on the day.

“Bitcoin’s (BTC-USD) initial reaction as a ‘risk off’ asset is not surprising,” Bernstein analyst Gautam Chhugani said.

Bitcoin failed as a flight to safety asset during recent market turmoil, crashing from $62,000 to $52,000 while other assets saw less significant declines, SA analyst Stony Chambers Asset Research said.

“When panic about the unwind of the Yen carry trade started to spread, people looked for liquidity and found Bitcoin standing there as an asset tradable 24/7/365, and able to absorb massive sell pressure,” said Cory Klippsten, CEO of Swan Bitcoin, a Bitcoin financial services firm.

The carry trade strategy involves borrowing currencies with low interest rates to invest in higher-yielding assets elsewhere. Investors rapidly unwound Yen carry trades over the past week as the currency strengthened after the Bank of Japan’s larger-than-expected rate hike.

“The yen carry trade and ongoing economic risks could continue to pressure asset prices, making caution prudent,” SA analyst Richard Durant said.

BTC, however, bounced back on Tuesday, as it regained some lost ground, and stayed above the $50K mark.

The cryptocurrency, especially, saw a rebound in its prices on Thursday, after the U.S. weekly initial jobless claims dropped more than expected, and provided some comfort to investors.

The price has bounced back from 48k to almost 60k over the course of the week as people buy the dip and reallocate back into this incredibly useful asset, Klippsten added.

Bitcoin’s recent drop was likely due to the forced unwinding of leveraged positions, making a short-term rebound likely, Durant added.

Notable News

- Dogecoin (DOGE-USD) is in a rarefied air – valued at billions of dollars more than 10 years from its launch – a status not shared by tens of thousands of memecoins because the majority of such projects perish quickly, according to a study published this week.

- Robinhood Markets (HOOD) has responded to the U.S. Securities and Exchange Commission’s Wells notice concerning its cryptocurrency business, CEO Vlad Tenev said.

- FTX (FTT-USD) and its trading partner Alameda Research have been ordered by a U.S. judge to pay $12.7B to their creditors, bringing to a close the 20-month lawsuit filed by the Commodity Futures Trading Commission.

- MicroStrategy’s (MSTR) Michael Saylor said he personally owns about $1B, of Bitcoin (BTC-USD) and will continue to accumulate more.

- The U.S. SEC asked a New York court to deny crypto exchange Coinbase Global’s (COIN) subpoena demanding that the regulator hand over “essentially all documents that in any way relate to crypto,” according to court documents.

- Marathon Digital (MARA) said its Bitcoin (BTC-USD) production in July increased 17% M/M to 692 BTC, while Riot Platforms (RIOT) produced 370 BTC.

Bitcoin, Ether prices

Bitcoin (BTC-USD) rose 1.1% to $60.3K at 3:14 pm on Friday. Ether (ETH-USD) was almost flat at $2.6K.

Bitcoin has entered its midcycle correction, said SA analyst Nikolai Galozi, adding “the Bitcoin dominance should peak during the next 1–2 months.”

Source link