Interest-rate forecasts from Federal Reserve officials sparked a mixed reaction from U.S. bond markets Wednesday, suggesting that investors still have questions on how much the central bank will actually tighten monetary policy.

Selling in short-term Treasurys indicated that investors were once again lifting their expectations for how high interest rates could rise this year. Initial selling in longer-term bonds quickly fizzled, however, in a sign that investors thought that a fast pace of interest-rate increases over the next several months could lead to fewer increases later.

Stocks climbed, with the S&P 500 rising 2.2% and the tech-heavy Nasdaq Composite surging 3.8%.

Matching investors’ expectations, the central bank on Wednesday lifted its benchmark federal-funds rate from near zero to a range between 0.25% and 0.5%. Officials, though, also substantially increased their forecasts for how high rates will climb over the next couple of years.

Overall, 12 out of 16 officials indicated that they thought rates would reach a range of at least 1.75% to 2% by the end of the year, with the median forecast ending up at roughly 1.9%. The median forecast for rates by the end of next year was around 2.8%.

“The Fed sent a strong signal to the market that it has the commitment and willpower to cool inflationary pressures,” said Gary Pollack, head of fixed-income trading at Deutsche Bank’s private wealth-management unit.

Investors, he added, had already thought that the central bank could raise rates at each of its remaining meetings this year. But they had also been betting that the Fed itself would signal more caution in its forecasts Wednesday, which is what caused short-term bond prices to fall and yields to rise when the forecasts were released.

By the end of the session, the yield on the benchmark two-year Treasury note settled at 1.956%, according to Tradeweb, up from 1.855% on Tuesday. The yield on the 10-year note settled at 2.185%, its highest level since May 2019 but just a modest increase from 2.160% on Tuesday and roughly unchanged from just before the Fed statement. The yield on the 30-year bond fell, sliding to 2.456% from 2.503% on Tuesday.

In some ways, analysts said, Wall Street’s reaction matched recent trends, with investors ready to adjust their interest-rate expectations for 2022 but being much less flexible beyond that point.

For 2023 and 2024, investors “do get skeptical,” said Priya Misra, head of global rates strategy at TD Securities in New York. “It’s further out,” she added. “Things could change. Maybe inflation does decline by then,” especially given what the Fed will likely do this year, both in terms of raising rates and shrinking its bondholdings.

Investors and economists pay close attention to Treasury yields because they set a floor on borrowing costs across the economy and are an important input in financial models that investors use to value stocks and other assets.

Heavily influenced by investors’ expectations for short-term rates set by the Fed, changes in yields can have a direct impact on the economy well before the central bank actually alters the rates that it controls directly. Already this year, there have been signs of a slowdown in housing demand thanks to rising mortgage rates, which are closely linked with the 10-year Treasury yield.

Many investors would accept slightly slower economic growth as long as the U.S. can avoid a recession and corporate profits can keep on growing. U.S. stocks have typically performed well when the Fed has started raising interest rates, largely because the central bank has taken those steps when the economy is in a strong position.

This year investors are more nervous than usual, with the S&P 500 down 8.6% for the year, because inflation is higher than it has been in decades. One risk is that the Fed might be willing to risk a recession, or accidentally cause one, as it tries to tame inflation.

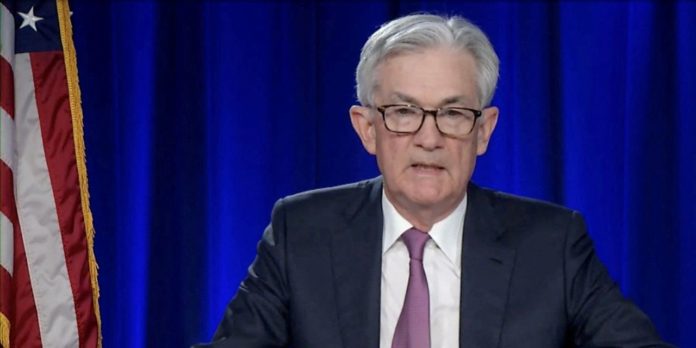

This year has already been a tough one for bond investors. When inflation started to accelerate last year, investors for months thought that it could subside on its own, allowing the Fed to keep short-term interest rates near zero. Those views, though, changed quickly this year largely because of a shift in tone from Fed officials, including Chairman

Jerome Powell,

who began expressing more concern about inflation and an eagerness to start raising rates.

This year’s one significant bond rally came at the end of February when Russia first invaded Ukraine, casting uncertainty over the economic outlook.

More recently, though, investors have grown more skeptical that the invasion can keep a lid on interest rates. Some have argued that higher commodity prices spurred by the invasion might only further stoke inflation, putting even more pressure on the Fed to tighten policy. Meanwhile, energy prices have already come down from their recent highs, driven in part by hopes for a negotiated settlement between Russia and Ukraine. That has eased the concern of those who thought the higher prices could have the opposite effect: slowing economic growth and making it harder for the Fed to raise rates.

SHARE YOUR THOUGHTS

Is the Fed doing enough to address inflation? Join the conversation below.

Regardless of the Fed’s actions Wednesday, monetary policies—and therefore bond yields—will still be largely determined by the state of the economy.

On that front, new data showed Wednesday morning that retail sales rose a seasonally adjusted 0.3% in February, below analysts’ forecasts for a 0.4% increase. At the same time, the increase in sales for January was revised upward to 4.9% from 3.8%.

Treasury yields were little changed just after the report. In a note to clients, Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, wrote that the data showed “a troubling trajectory” but that the upward revisions to January sales did “take the edge off of the disappointing Feb numbers.”

Write to Sam Goldfarb at sam.goldfarb@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Source link