(Bloomberg) — Asian stocks advanced after China’s central bank announced stimulus measures in a bid to reach this year’s economic growth target and stem a selloff in the equity market.

Most Read from Bloomberg

Shares in Hong Kong gained the most, with key benchmarks rallying at least 3%, while onshore Chinese indexes rose more than 2% as authorities said they are studying setting up a stock stabilization fund. The MSCI Asia Pacific Index climbed 0.8%. Most Asian currencies strengthened against the dollar.

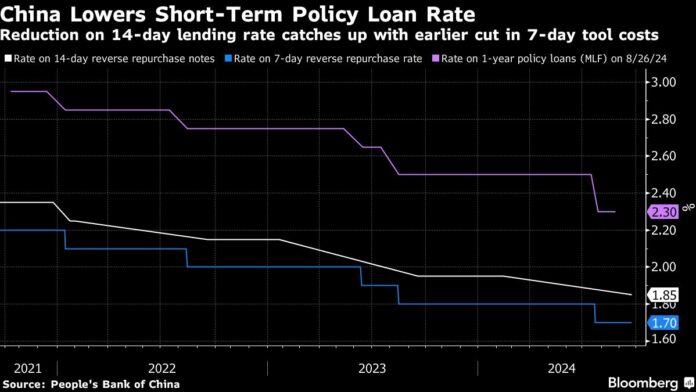

China is planning at least 800 billion yuan ($114 billion) of liquidity support for stocks and will allow brokerages and funds to tap the central bank’s funding to buy equities after the benchmark CSI 300 Index fell to more than a five-year low earlier this month. That came as part of a broad package of policy measures to revive the economy, including a cut to a key short-term interest rate and lower borrowing costs on as much as $5.3 trillion in mortgages.

While the initial market response following the stimulus measures was positive, analysts see a risk that the rally may soon fizzle as some of the fundamental issues plaguing China’s economy, including deflationary pressure, remain unsolved.

“These measures clearly show Beijing now understands and appreciates the urgency of boosting stock market and housing market sentiment,” said Siguo Chen, portfolio manager at RBC BlueBay Asset Management. “Short term, it will help the market find a bottom, but long term I think we need to see more fiscal support.”

The People’s Bank of China will set up a swap facility allowing securities firms, funds and insurance companies to tap liquidity from the central bank to buy stocks, the governor said at a Tuesday briefing. China’s 10-year government bond yield erased its drop after earlier falling to 2% for the first time on record.

“This kind of measure can raise more funds, increase market liquidity, and can also improve market confidence to a certain extent in the short term, but it cannot change the market trend,” said Zhou Nan, founder and investment director at Shenzhen Long Hui Fund Management Co. “There is a high probability that in the short and medium term, the market will have to fall further before it bottoms out.”

Elsewhere in Asia, the Reserve Bank of Australia kept its cash rate target at 4.35% for a seventh straight meeting and restated it isn’t “ruling anything in or out” on policy. The Australian dollar held an earlier gain while the yield on policy sensitive three-year notes fluctuated after the decision.

US stock futures edged lower after the S&P 500 closed up 0.3% in the previous session, a whisker away from last week’s all-time high. The yield on policy-sensitive two-year Treasuries was little changed at 3.59%. Traders have been wagering on nearly three-quarters of a point of policy easing by year end, suggesting at least one more jumbo rate cut is in store.

Data released Monday showed US business activity expanded at a slightly slower pace in early September, while expectations deteriorated and a gauge of prices received climbed to a six-month high, stoking confidence the world’s largest economy can nail a soft landing. Investors are now awaiting data on the Fed’s preferred price metric and US personal spending later this week.

Chicago Fed President Austan Goolsbee said with inflation approaching the central bank’s target the focus should turn to the labor market and “that likely means many more rate cuts over the next year.”

Neel Kashkari at the Minneapolis Fed also pointed to weakness in the job market, saying he backs lowering interest rates by another half percentage point by year end. His counterpart at the Atlanta Fed, Raphael Bostic took a moderate stance. Starting the central bank’s cutting cycle with a large step would help bring interest rates closer to neutral levels, but officials should not commit to a cadence of outsize moves, according to Bostic.

Gold hit a fresh record of $2,636.16 per ounce during Asian market hours after several Fed officials appeared to leave the door open to additional large rate cuts. Oil edged higher after Israel launched airstrikes on Lebanon that killed nearly 500 people and boosted regional tensions.

Key events this week:

-

Japan Jibun Bank Manufacturing PMI, Services PMI, Tuesday

-

Mexico CPI, Tuesday

-

Bank of Canada Governor Tiff Macklem speaks, Tuesday

-

Australia CPI, Wednesday

-

China medium-term lending facility rate, Wednesday

-

Sweden rate decision, Wednesday

-

Switzerland rate decision, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, durable goods, revised GDP, Thursday

-

Fed Chair Jerome Powell gives pre-recorded remarks to the 10th annual US Treasury Market Conference, Thursday

-

Mexico rate decision, Thursday

-

Japan Tokyo CPI, Friday

-

China industrial profits, Friday

-

Eurozone consumer confidence, Friday

-

US PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 1:09 p.m. Tokyo time

-

Nasdaq 100 futures fell 0.2%

-

Japan’s Topix rose 0.8%

-

Australia’s S&P/ASX 200 fell 0.3%

-

Hong Kong’s Hang Seng rose 3.3%

-

The Shanghai Composite rose 2.4%

-

Euro Stoxx 50 futures rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1110

-

The Japanese yen fell 0.2% to 143.89 per dollar

-

The offshore yuan rose 0.3% to 7.0409 per dollar

Cryptocurrencies

-

Bitcoin fell 0.4% to $63,053.38

-

Ether fell 1.5% to $2,623.32

Bonds

-

The yield on 10-year Treasuries was little changed at 3.76%

-

Japan’s 10-year yield declined one basis point to 0.820%

-

Australia’s 10-year yield was little changed at 3.95%

Commodities

-

West Texas Intermediate crude rose 1% to $71.08 a barrel

-

Spot gold rose 0.2% to $2,633.09 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Mark Cudmore, Winnie Hsu, Zhu Lin and April Ma.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link