The size of Chipotle’s (NYSE: CMG) portions has come under scrutiny recently thanks to a viral trend on social media app TikTok — customers have been videoing employees making their burrito bowls to make sure they were filling them properly.

The start of this trend can be traced to influencer Keith Lee, who has over 16 million followers, and who criticized the company for its shrinking portions. This prompted some Chipotle customers to begin videoing the chain’s employees to incentivize them to give them more food. More and more customers followed suit.

This trend could impact the company’s results and stock in the short term, and may have longer-term implications as well.

My recent Chipotle orders

Since these complaints about Chipotle’s portions went viral, I’ve ordered bowls from Chipotle twice from two different locations in two different states. Immediately following the hoopla, I placed a steak bowl order for pick-up through a drive-thru “Chipotlane” and received the fullest bowl I’ve ever gotten. No video was needed (or possible), and the portion size was great.

Two days later, I ordered two more bowls at my local Chipotle, and the results were completely different. One bowl was about half the size of the one I had gotten two days earlier and the other was maybe a third of that size. The chips were also stale.

After I reached out to customer service, they gave me two BOGO (buy one, get one free) offers to use in the next 30 days and a free chips and guacamole reward. They also said they’d contact the store’s manager.

Over the past year, I have consistently had issues both with food quality and portions at my local Chipotle, which is one reason I’ve avoided the stock. However, given the strong sales momentum the company has seen during this time, my belief is that those were likely isolated issues relating to that single location. This is also an example of how anecdotal evidence is sometimes just that — anecdotal — and may not reflect the big picture.

For the company’s part, Chipotle has said that it has neither altered its portion sizes nor instructed employees to give fuller bowls to customers who were recording them. The company did say that it had “reinforced proper portioning” with its employees, but did not indicate whether “proper” means keeping those portions moderate or filling the bowls up.

Based on my recent experiences, there are big differences in portion sizes from one Chipotle location to the next.

How this could impact the company’s results

Chipotle’s biggest expense category is food, beverage, and packaging — costs on that front represented 28.8% of its revenue in Q1. The company has been constantly fighting food inflation by boosting prices. However, another way for food companies to keep profits up when their costs are rising is by reducing portion sizes. This is commonly referred to as shrinkflation. President Biden even called out shrinkflation in his State of the Union address earlier this year.

In the near term, if Chipotle does indeed increase its portion sizes to mollify its customers, that would increase its food expenses and hurt its restaurant-level margins. A 10% increase in expenses in the food, beverage, and packaging category from larger portions would add about $330 million a year in additional expenses (nearly $260 million after taxes), or about $9.40 in annual earnings per share (EPS), based on expected sales of $11.35 billion this year. That’s not a small amount, even for a company on course to earn more than $55 per share this year.

In the long term, if Chipotle keeps its larger portion sizes, it would have a lasting impact on margins, while smaller sizes could have an impact on demand. Right now, there seems to be a bit of a battle between Chipotle and its customers over this issue.

This is a bit of a vulnerable time for the company. Many other quick-service chains have felt pressure from consumers struggling with higher menu prices. Chipotle has thus far avoided this, as evidenced by its strong same-store sales, pricing power, and traffic.

Skimping on portions and quality may boost results in the near term, but eventually, it could catch up to the company. Chipotle has a good reputation and has bounced back from worse, including a number of food poisoning incidents related to E. coli and norovirus, but now, it needs to maintain that good reputation.

I think the company missed an opportunity when Lee’s complaint and other TikTokers’ response to it went viral. It could have played into some marketing that would have driven more customers to its restaurants, perhaps for a limited time, by promoting the size of its bowls. The company’s ambiguous response regarding its portion sizes also wasn’t helpful.

Time to buy, sell, or hold?

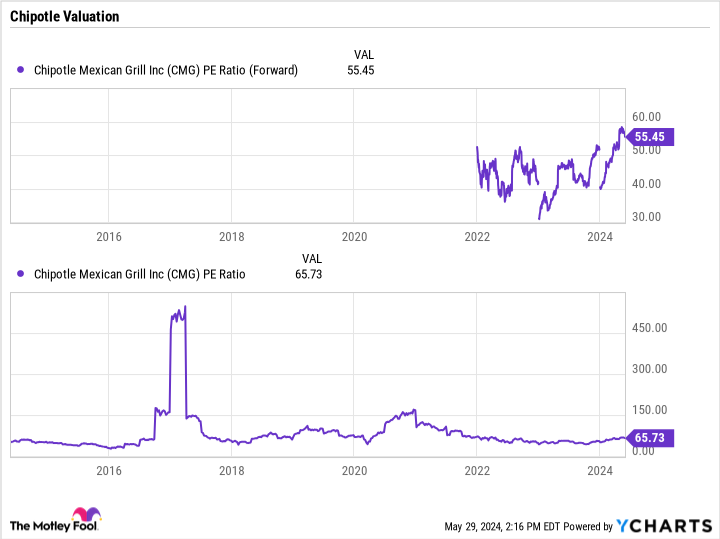

Chipotle stock now trades at a forward price-to-earnings (P/E) ratio of 55.5 — a premium valuation relative to its growth and margin profile. It doesn’t quite have the long expansion opportunity it has had in the past, so same-store sales and restaurant-level margins will play a bigger role in its long-term prospects.

Not long ago, an event like the Chipotle portion saga would have likely been forgotten fairly quickly. Historically, consumers have had short memories when it comes to things like this. However, in the era of social media, consumers have been gaining more power. So I wouldn’t 100% write it off as I would have done several years ago. I never thought Bud Light sales would still be impacted a year after calls by some to boycott the brand, so you never know.

At this point, given Chipotle’s valuation, I’d view the restaurant stock as more of a hold while we wait to see whether this blows over as expected. I think it will, but I wouldn’t rush to buy the stock at these levels.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Chipotle’s Portion Sizes Have Gone Viral. What Could That Mean for the Stock? was originally published by The Motley Fool

Source link