Thomas Kelley/iStock Editorial via Getty Images

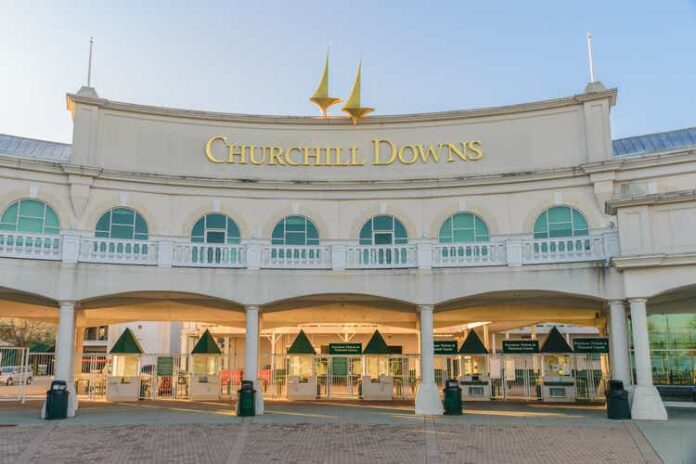

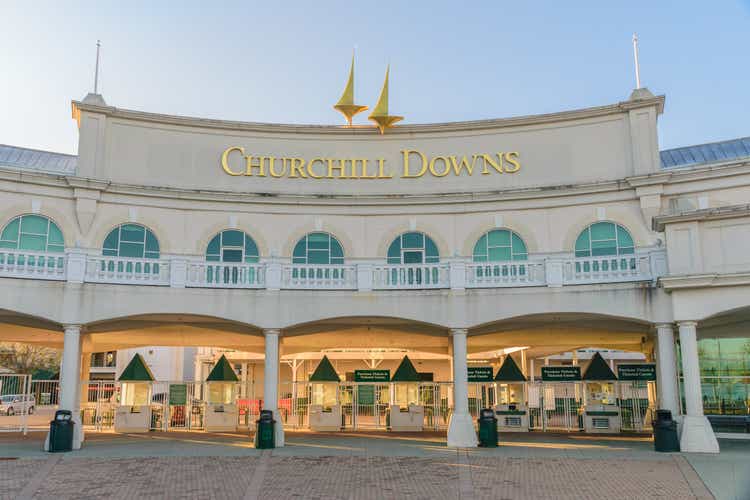

Bank of America upgraded Churchill Downs Incorporated (NASDAQ:CHDN) on Monday to a Buy rating from Neutral on the firm’s view that the company presents a unique, idiosyncratic set of assets and capital-driven growth within the broad gaming sector.

Analyst Shaun Kelley highlighted that Churchill Downs (CHDN) has a unique organic growth pipeline, driven by greenfield development and high return on investment additions to the Derby. Sustainable double-digit growth was noted to be driven by a strong opening of the Terre Haute casino in Q2, the upcoming Rose historical racing machine facility in Northern Virginia in Q3, a new HRM property in Owensboro, Kentucky in 2025, and additional ROI capex at the Derby.

“We are excited about the potential for the Rose in particular given the densities and low competition in Northern VA and beyond 2025 can see growth carry on from additional HRM’s in Virginia and NH.”

In terms of valuation, BofA thinks an 11.4X 2025 EBITDA trading multiple for CHDN justified, even though it is well above the gaming peer average of 6.8X. “We think Churchill Downs is unique with a pipeline to deliver double-digit EBITDA growth, while Gaming peers are struggling to grow organically at all,” noted Kelley.

Q2 earnings recap: Churchill Downs (CHDN) sailed past consensus estimates with the company’s Q2 earnings report. Revenue increased 15.9% year-over-year to $890.7 million for the quarter that included record results from the Kentucky Derby. Adjusted EBITDA increased $55.7 million in Q2 due to a $38.1 million increase at Churchill Downs Racetrack, a $16.1 million increase attributable to growth at CHDN’s Virginia properties, and a $1.5 million increase from growth at other HRM properties. Churchill Downs (CHDN) said it ended the quarter with net bank leverage of 4.0X.

Shares of Churchill Downs (CHDN) rose 1.45% in premarket trading on Monday to $135.60 vs. the 52-week trading range of $106.45 to $146.64.

Source link