Cleveland-Cliffs (CLF) shares closed more than 20% higher today after the NYSE-listed company signalled a potential expansion into rare earth mining.

CLF is already exploring its existing mines in Michigan and Minnesota that show promising signs of rare-earth deposits according to a press release on Monday.

Including today’s rally, Cleveland-Cliffs stock is up more than 170% versus its year-to-date low.

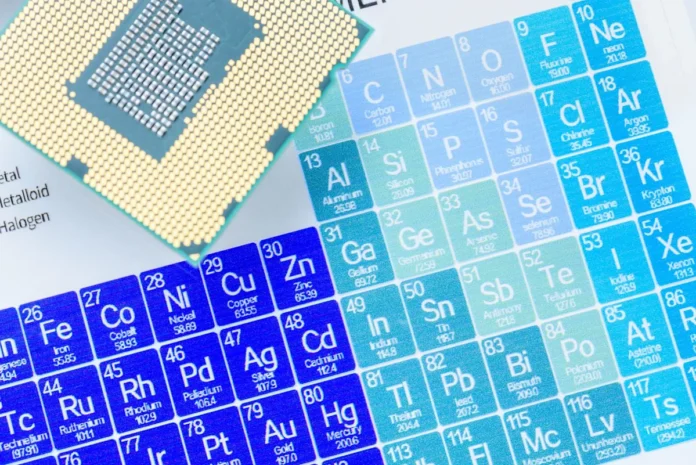

CLF’s announcement is particularly timely given the escalating trade tensions with China, which currently dominates the global rare earth market, controlling about 70% of the mining capacity.

Beijing has recently slapped export restrictions on rare earth elements, heightening concerns about supply chain vulnerabilities. This makes Cleveland-Cliffs’ domestic exploration efforts even more relevant.

Simply put, the potential expansion could align CLF stock with broader national security interests.

President Donald Trump’s administration has already signed several rare earth deals – including an $8.5 billion partnership with Australia – demonstrating strong federal support for domestic rare earth mining.

Therefore, if the company does indeed proceed with the signalled strategic expansion, Cleveland-Cliffs shares could retain momentum and climb to new highs in 2026.

On Monday, the mining company also posted not-so-encouraging results for its fiscal third quarter, with revenue coming in at a lower-than-expected $4.73 billion on an adjusted per-share loss of $0.45.

However, there were some positives in the financial release as well. For example, steel (HVX25) shipments, CLF’s core business, saw an increase to 4.03 million net tons on improved demand from the global automotive sector.

Cleveland-Cliffs also demonstrated fiscal responsibility by reducing its full-year capital spending forecast from $600 million to $525 million and lowering administrative costs guidance, bolstering the bull case for CLF shares.

The mining firm also disclosed a new memorandum of understanding (MOU) with a major global steel producer, which management expects will be highly accretive to shareholders.

Source link