quantic69

Fundstrat’s Tom Lee said the U.S. equity market can find further upside from the Federal Reserve beginning rate cuts and an Nvidia (NASDAQ:NVDA) financial update that underscores solid footing for the AI investment theme.

Lee, head of research at Fundstrat Global Advisors, appeared on CNBC on Thursday, a day after the Fed’s July meeting minutes indicated “several” policymakers were ready to start reducing interest rates in September. Investors had also received a downward revision of federal job growth estimates over the 12 months ending in March.

The “revisions that just came out show a lot of jobs disappeared. It’s not as strong of a [jobs] market, and I think it gives more ammunition for the Fed to start a cutting cycle,” Lee said. “That’s going to give a lot of life to the economy and to the [stock] market, especially cyclical stocks and small-cap stocks,” he said.

Lee spoke before Federal Reserve Chair Jerome Powell on Friday was expected in his Jackson Hole symposium speech to signal by how much policymakers will begin cutting interest rates.

The U.S. economy doesn’t appear to be entering a recession and the probabilities of a soft-landing are going up, Lee said. “That’s why this should be a benign cutting cycle – good for markets,” he said.

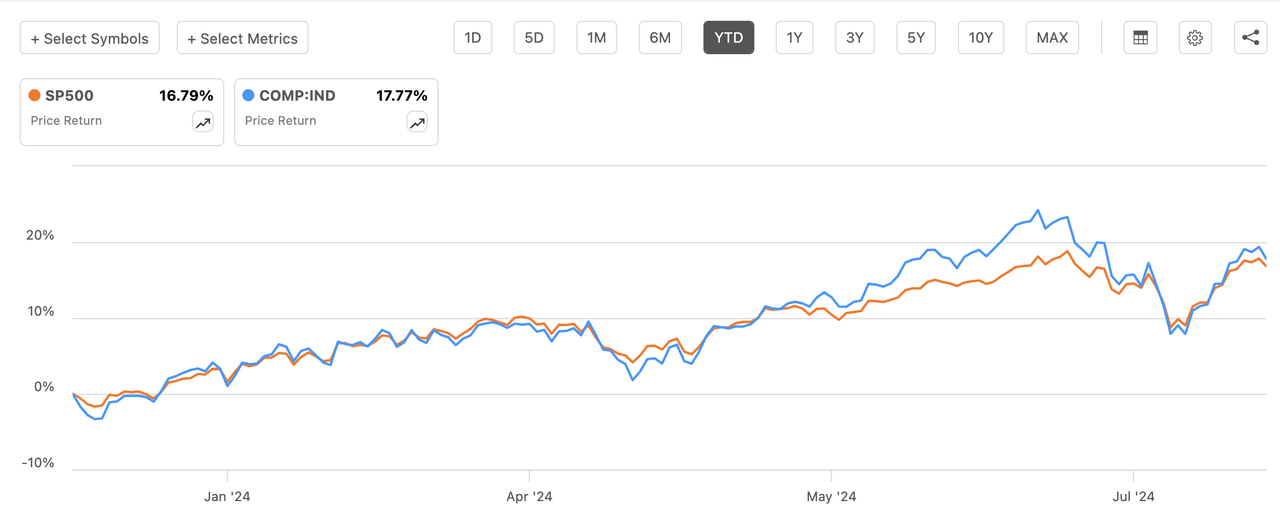

The stock market (SP500)(COMP:IND)(DJI) has demonstrated strength by sharply snapping back from a “gut-wrenching” rout earlier this month ignited by a U.S. economic growth scare, Lee said. A slide in technology stocks (XLK) pulled the Nasdaq Composite (COMP:IND) into a correction, but the average has since narrowed its loss to sit 5.5% below its all-time closing high.

“I think tech is still in a good place because of AI, and Nvidia (NVDA) should reinforce that,” Lee said, ahead of the Aug. 28 release of the AI chipmaker’s Q2 results. Lee said Nvidia’s (NVDA) multiple isn’t demanding.

“Nvidia is maybe 28 times forward earnings, which, for one of the most important companies in the world, it’s not a high multiple,” he said. “So if tech is in a good place, and then we get Fed cuts, I think it allows the overall market to expand.”

The S&P 500 (SP500)(SPY)(IVV) stood 1.7% below its all-time closing high of 5,667 as of Thursday. This year, it’s risen 16.8%. The Nasdaq Composite (COMP:IND) was up 17.8% YTD as of Thursday.

Source link