Of course not, but politicians want them. What’s the real problem and solution?

Runaway Insurance Costs Bring Back Talk of Price Caps

Rate caps have moved to the forefront. The Wall Street Journal reports Runaway Insurance Costs Bring Back Talk of Price Caps

Illinois lawmakers are considering a ban on home insurers hiking rates because of catastrophes in other states. Louisiana recently handed its regulator the power to strike down “excessive” premiums.

New York lawmakers are investigating soaring home-insurance costs, with a view to potential new curbs. In Michigan, Democratic lawmakers this summer proposed a law to impose a 10% cut in auto-insurance rates.

“Rate increases are top of mind for every policymaker across the country. Consumers are going to them and saying, ‘I can’t deal with a 30% rate increase, or a 40% rate increase’,” said Jon Godfread, president of the National Association of Insurance Commissioners.

“The increases are so big—you just think ‘wow, what’s going on’,” said Jarrad McCarthy, a Chicago sales executive. In the past two years, the annual cost of insuring his three-bedroom home has increased 47%, from $1,312 to $1,929.

Coverage for his Hyundai Tucson has gone up even more: The six-month premium jumped 62%, from $584 in June 2023 to $946 this summer.

Some lawmakers see rate controls as the answer. Illinois Democratic Gov. JB Pritzker backed the state gaining a veto over price increases this summer, after lashing out at an “unfair and arbitrary” 27% hike in home-insurance rates by State Farm.

California for decades had an effective 6.9% ceiling on premium increases. That kept its home-insurance rates below the national average, despite pricey real estate and vulnerability to wildfires.

But a pullback by major home insurers has plunged the market into crisis. To try to woo them back, regulators in recent months greenlighted double-digit home-insurance rate increases far in excess of the historic norm.

“I may be criticized and dragged through the mud for it…but I don’t care,” Insurance Commissioner Ricardo Lara said, after backing a 17% increase for State Farm. “We can’t just talk about affordability without first addressing availability. You can’t afford what doesn’t exist.”

Disaster-prone Louisiana last year axed a requirement for rate increases to be approved by regulators, to try to attract more insurers to the state, only to this year impose fresh controls. A new law allows regulators to strike down any “excessive” rate—defined as one likely to produce unreasonably high profits—and even demand refunds from insurers.

You Can’t Afford What Doesn’t Exist

Insurers leave states when caps and regulators don’t permit risk based prices. California is proof enough.

And insurers distribute costs elsewhere. Causing what the hell reactions from homeowners.

Price Caps Not the Answer

Price caps are not the answer because they cause two distortions.

- Unavailability of insurance at any price in some places

- Rising costs in other places to make up for losses

What’s the Real Problem?

- The price of homes has soared.

- The price of labor has soared.

- The price of materials to make repairs has soared.

In a single word, the real problem is inflation, not price gouging, not fires, not hurricanes, not climate.

Nonsensical BLS Chart

The BLS says the cost of homeowners insurance index has risen form 151 to 165 since January of 2020.

That’s an increase of 9.3 percent.

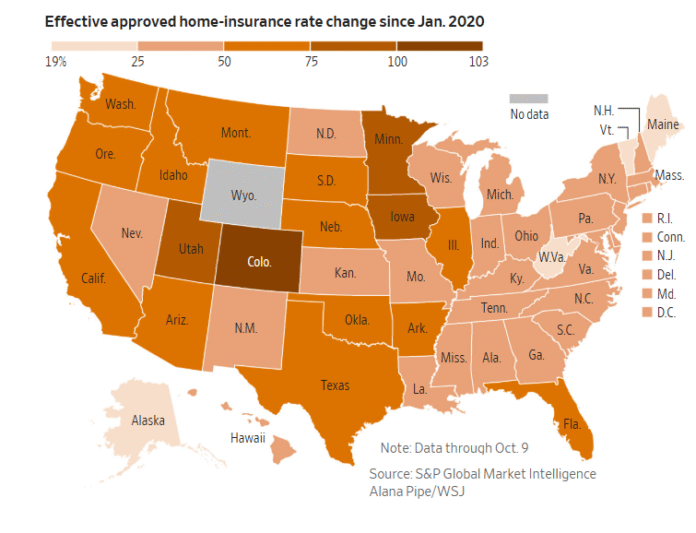

The minimum increase, in only four states (Alaska, West Virginia, Vermont, and Maine) is 19-25 percent.

The average increase is on the order of 50-75 percent and much higher for anyone in a flood zone, hurricane zone, or fire zone.

Not Inflation?

That’s what the Fed thinks and foolish economists think. Neither home prices nor insurance prices nor property taxes are in the CPI.

Pea-brain economists call all of these things capital expenses not consumer expenses as if they don’t matter.

Excellent Reader Comment

I’m outspoke on the hidden costs of tariffs. For decades China was coming on with more and more cheap replacement car parts. That has largely played out.

Even worse there’s stiff tariffs happening to those parts. Goodbye cheap repairs!

Trump’s tariffs and made-in-the-US policy are driving up the cost of everything.

Is Homeowners Insurance Understated in the CPI?

The CPI is fatally broken as a measure of inflation.

Thus, all this talk about falling inflation by Trump and others is idiotic.

I discussed this on August 11, 2025, in Is Homeowners Insurance Understated in the CPI? Shop Around!

Our Insurance went up by $2,000. Then another $2,000. Here’s our story.

But look on the bright side, Trump Says There Is ‘Virtually No Inflation.’

What to Do About Inflation?

- Throw away the CPI and PCE as nonsensical measures of inflation

- Revamp the CPI and PCE incorporating property taxes and the true cost of homeowners’ insurance.

- Tell everyone the truth.

- Admit we have a spending problem in Congress

- Admit we have an executive promoting spending problems in Congress

- Admit we have a Fed problem papering over the Congressional spending problems

Q: But we are not going to do any of those things are we?

A: Of course not.

Expect more lies from Congress, from Trump, from the Fed, and from economists all of whom are ignorant about inflation.

Gold and Silver Get the Message

Please note India’s Largest Metals Refinery Ran Out of Silver for the First Time in History

- Shortages hit London too. The silver market is broken.

Also note Zero Progress on the Reducing the Deficit Despite Tariff Revenue

For fiscal year 2025, the deficit is $1.8 trillion, similar to 2024.

Looking ahead, don’t forget to tack on Obamacare subsides because there will be a deal. Also factor in Trump’s “Golden Dome Defense Shield for America”.

And who the hell knows what Trump is going to get us into in Venezuela, Afghanistan, or Gaza.

Finally, none of these long-term budget projections factor in a recession, ever.

Finally, please note Gold Surges $100 to New Record High Above $4,300 as Bond Yields Dive

Gold reiterates its message: Spending is out of control with no faith in the Fed.

Gold and silver do not believe the Fed, Congress, Trump, or anyone else will address the problems. And neither do I.

Heck, none of the above even understand inflation at all.

Source link