The $20 billion swap announced by Bessent (not on US Treasury website as far as I can tell) is funded out of the Exchange Stabilization Fund. As far as I can tell, there’s no conditionality. This transaction is qualitatively different from Fed swap lines with for instand ECB and BoE wherein the Fed had access to their currencies.

Hence, the swap is essentially a loan from US Treasury (i.e., you and me, American taxpaers). I want to know what’s the collateral. Hopefully, we’re not relying on the reliability of Argentina to stabilized its currency…

So far, the Treasury intervened on Friday. It’s not clear that worked to stabilize the currency.

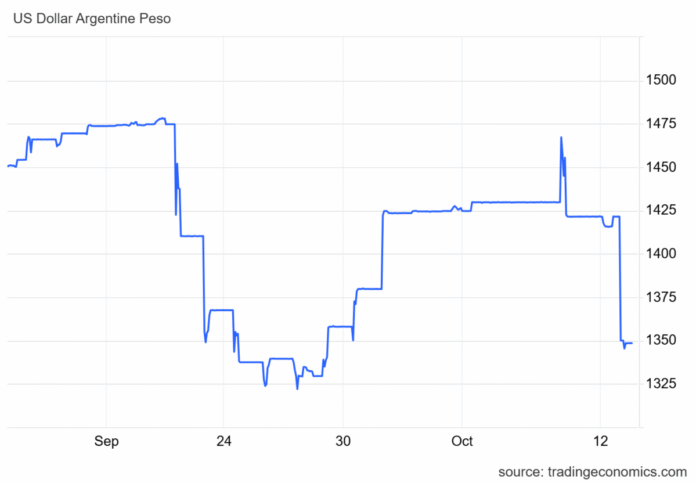

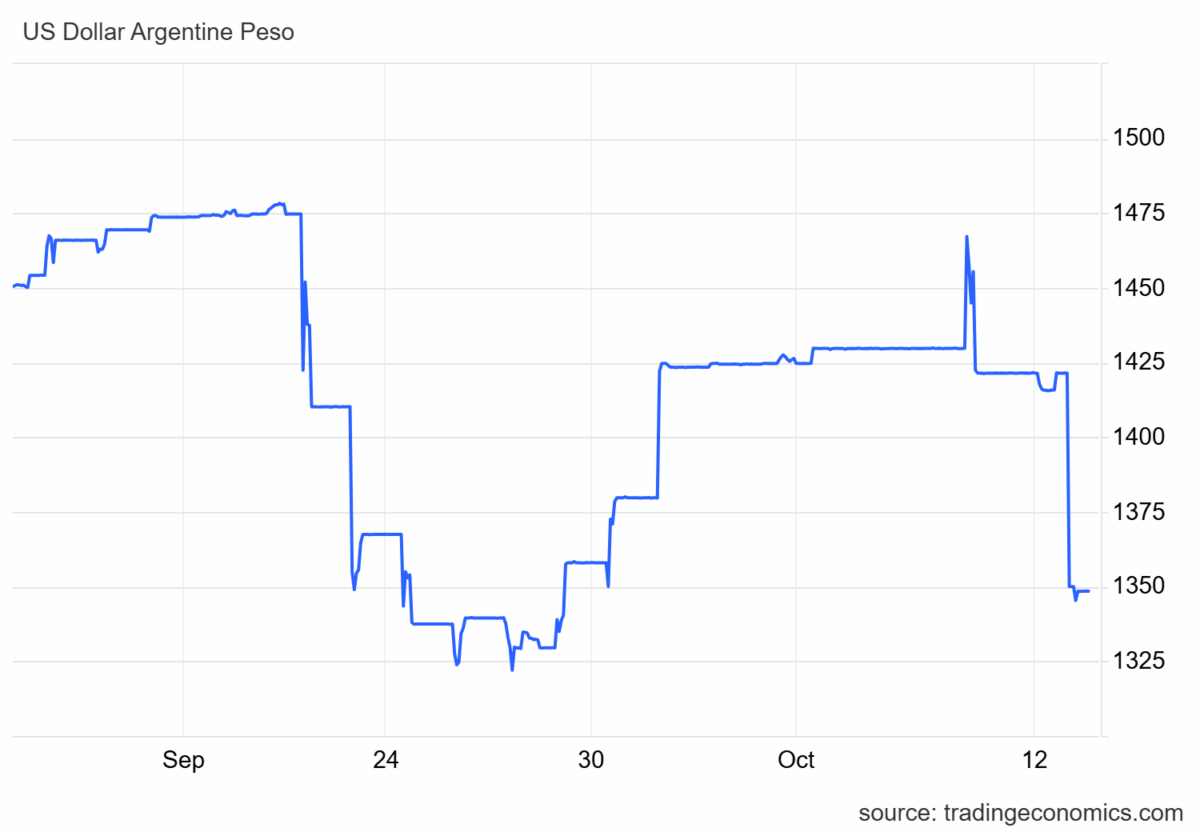

Here’s the Argentine peso’s value over the last month:

Source link