The markets have been shaky and it shows – the VIX, often referred to as the “fear index”, is clearly signaling elevated levels of anxiety:

In times like these, investors and traders always rush into what’s called “defensive stocks” – companies that are likely to remain stable and perform well regardless of the state of the bigger market & economy.

A classic example of “defensive stocks” are utilities, and it makes sense, right? When times are tough, you may refrain from just about any unnecessary spending, but you will still always pay for your gas, water, and electricity.

I could’ve just given you a list of these and be done…but as you know, at RagingBull we do things differently!

We make the extra effort and go a step further to provide you with unique trade ideas.

That’s why our main weapon against the bear market is… Pfizer (PFE)!

I’ll let the idea’s author, our own Ben Sturgill, explain why and what trade to look for.

Much like utilities, the fundamental story behind Pfizer makes sense, right?

Never mind the economic environment, there will always be a demand for life-saving drugs and therapies.

Add to that the company’s COVID-19 treatments, which are likely to remain “cash cows” for the foreseeable future and you’re getting a business that should perform relatively well under most market circumstances.

But it’s not just the fundamental side… It’s the price action that gets Ben really excited.

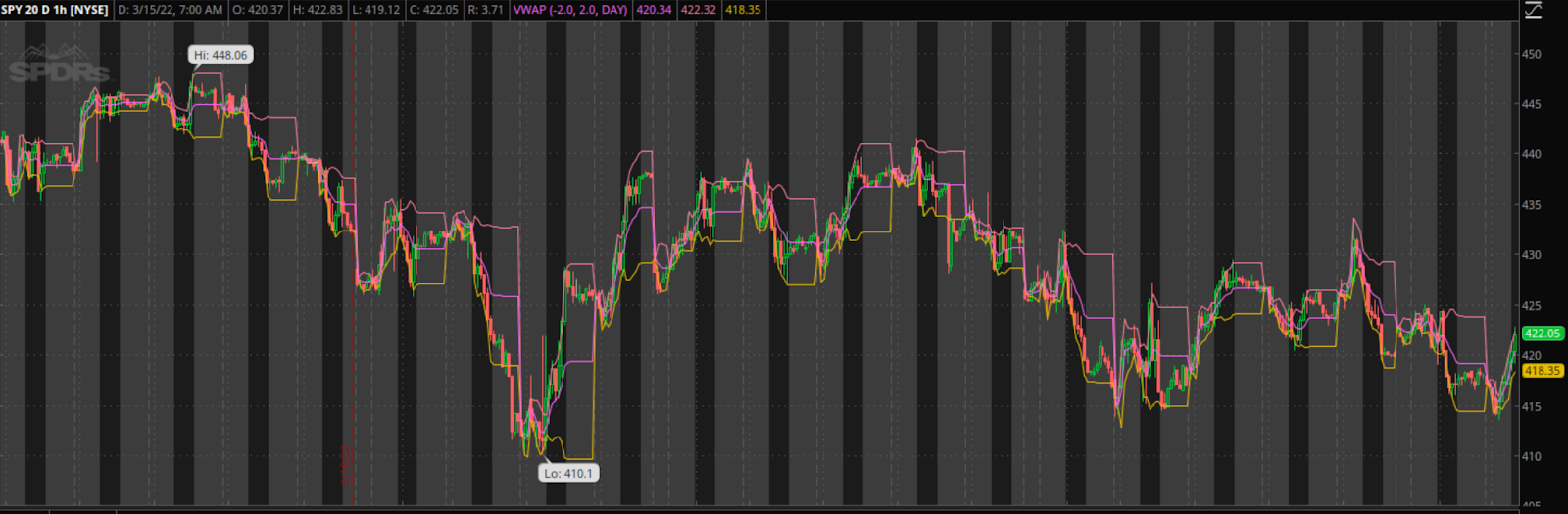

Let’s look at 2 charts. Here’s SPY over the past 20 days:

All over the place and clearly heading lower.

Here’s PFE, over the same exact 20 days:

One is not like the other, that’s for sure!

PFE has been ripping higher lately, all in the face of the crumbling market and rising fear.

The stock’s relative strength is unparalleled and price performance is clearly making a statement.

Hence, I quote Ben: “I’d like to take a small shot here to play that continued momentum.”

Here’s the actual contract he is considering:

PFE March 25 $52 Calls above $1.60, if PFE is Above $52.

Target is $1.80+.

Stop is PFE below $51.90

Let’s see how this plays out over the next few days!