Charles Schwab on Tuesday highlighted the outperformance of a key barometer of U.S. small-cap companies over Wall Street’s benchmark S&P 500 (SP500) in H2 of 2024 so far, a trend that shows how market breadth has moved out of megacap stocks and into other areas.

The S&P 500 (SP500) powered to a more than 14% gain in the first six months of this year, largely driven by a blistering rally in technology stocks over the artificial intelligence (AI) craze. The Magnificent 7 companies also played a major part in the bull run as they swelled in market cap. In that same time period, the S&P Small Cap 600 index (SP600) fell 1.61%.

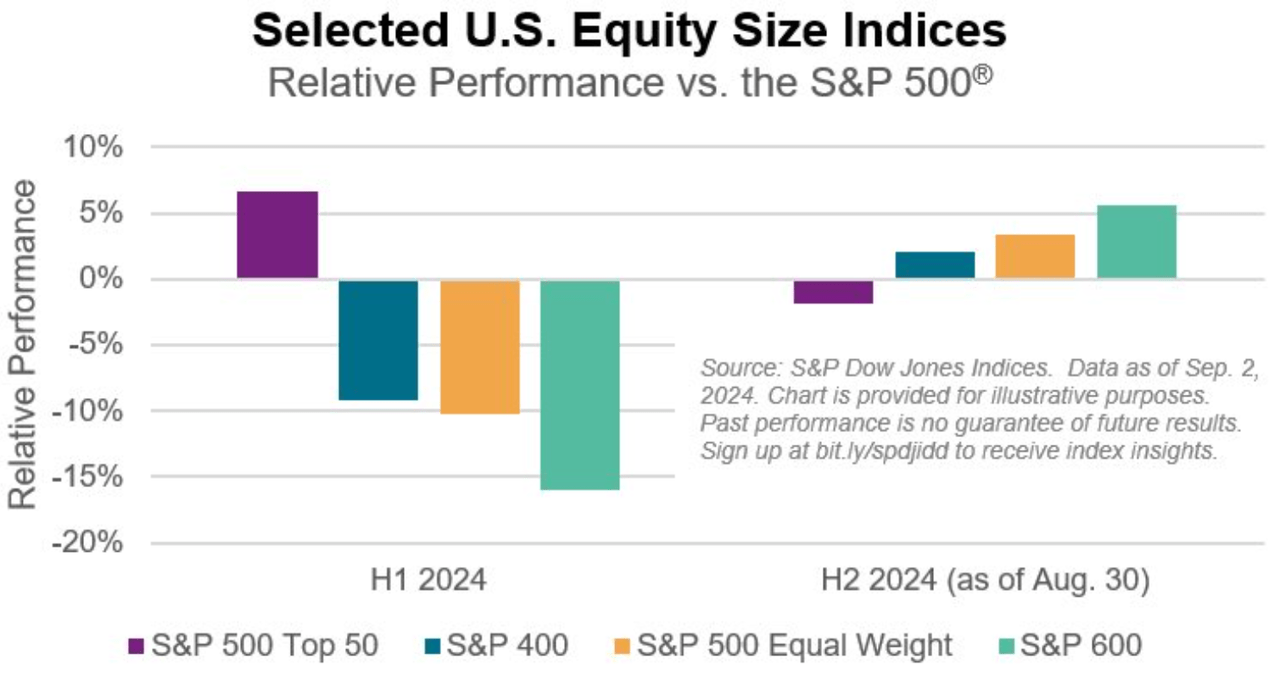

But in H2 so far, the small-cap gauge has outperformed the benchmark S&P 500 (SP500). The SP600 has added 5.55% versus the SP500’s 1.09% climb.

“While upward trend in U.S. equities has remained intact in 2H2024, leadership has moved from behemoths to minnows,” Liz Ann Sonders, chief investment strategist at Charles Schwab, said on X (formerly Twitter) on Tuesday.

Sonders shared the following chart spotlighting the performance of selected U.S. equity averages in H1 and H2:

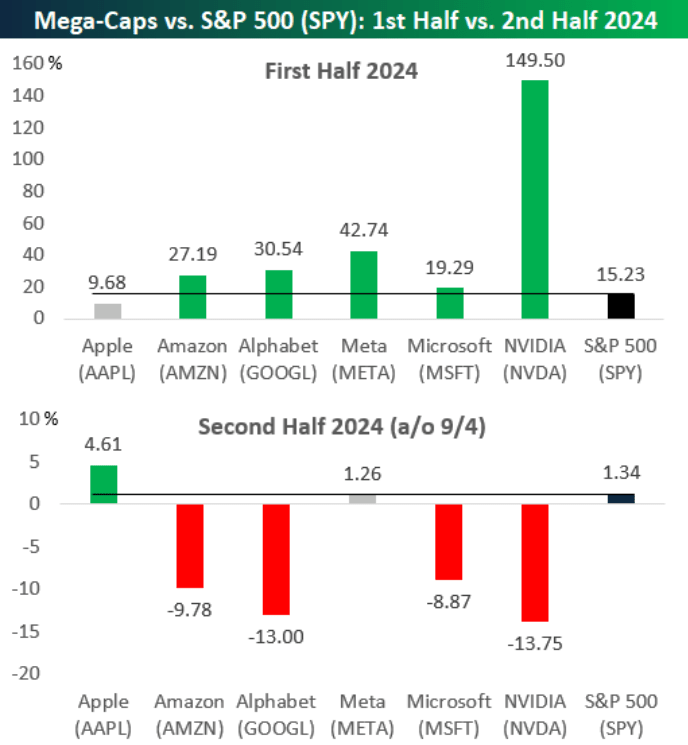

Meanwhile, Bespoke Investment Group on Wednesday showed how the megacap tech stocks are now lagging the S&P 500’s (SP500) accompanying SPDR S&P 500 ETF Trust (NYSEARCA:SPY).

“In the first half of 2024, five of six mega-cap Tech stocks outperformed the S&P 500 ETF’s $SPY 15.2% gain. So far in the 2nd half, only one of six is outperforming the S&P’s 1.34% gain, and four are down at least 8%,” Bespoke said on X.

See below the chart shared by Bespoke:

A rotation out of the megacap technology stocks began in the second half of July, driven by a soft June consumer inflation report that gave investors the confidence to start moving out of those heavyweight names and into other assets.

Another indication of the rotation and change in market leadership lies in the performance of the S&P 500 equal weight index. The equal weight index includes the same constituents as the capitalization weighted S&P 500 (SP500), but each company in the equal weight gauge is allocated a fixed weight, meaning that the likes of Nvidia (NVDA) carry the same heft as Dollar Tree (DLTR).

In H1 2024, the equal weight index rose 4.07% compared to the S&P 500’s (SP500) 14.48% increase. So far in H2, the equal weight index has added 5.27% versus the SP500’s +1.09%.

For investors looking to track the benchmark S&P 500 (SP500), here are some exchange-traded funds to follow: (SPY), (VOO), (IVV), (RSP), (SSO), (UPRO), (SH), (SDS), and (SPXU).

More on the markets

Source link