-

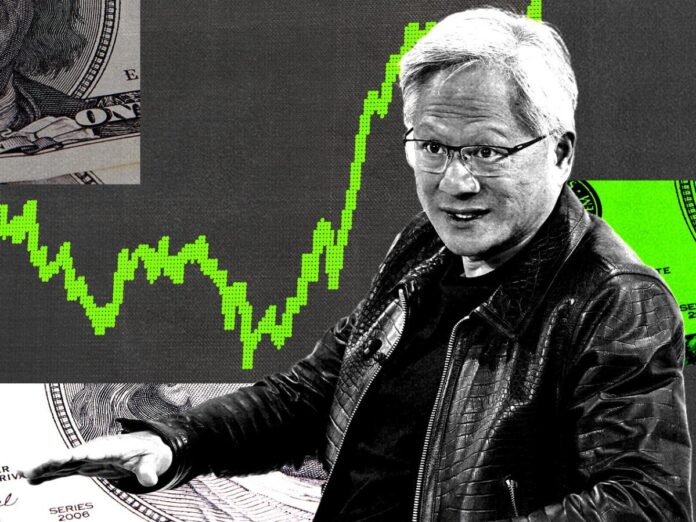

Nvidia stock is still cheap based on a forward price-to-earnings multiple, according to a hedge fund manager.

-

Eric Jackson expects Nvidia stock to hit $250 per share by the end of the year, doubling from current levels.

-

Nvidia’s market cap could hit $6 trillion, bolstered by strong chip sales and investor euphoria.

Nvidia stock is set to continue its wild rally through the end of the year, according to hedge fund manager Eric Jackson of EMJ Capital.

Jackson expects Nvidia stock to hit $250 by the end of the year, representing potential upside of 101% from current levels.

Such a rally, if it materializes, would value the AI-chip company at a stunning $6 trillion.

And it’s all because Nvidia stock is still cheap on a valuation basis, according to Jackson.

“Over the last five years, Nvidia’s average look forward price-earnings multiple has been 40 times. Yesterday, after this two-day correction, it was 39 times forward price-earnings. But there have been three times in the last five years where it’s had a look forward price-earnings multiple of over 50x, and two times in the last five years where it’s gotten just about to 70x and then it pulled back. So we just haven’t seen that euphoria yet,” Jackson told CNBC on Tuesday.

Jackson is betting that as investors start to focus on Nvidia’s earnings potential in 2025 and 2026, euphoria could drive Nvidia well above its average forward P/E multiple and closer to its peak.

“This is a high flyer, and expectations can reset on a bad earnings report, but they can also get equally overhyped on good news. And despite the fact the stock has had this enormous run, the euphoria hasn’t yet caught up in terms of the go-forward multiple,” Jackson said.

Shares of Nvidia have already soared 151% year-to-date, and the chip maker was briefly the most valuable company in the world at its peak last week, with a market valuation of about $3.3 trillion.

“I think what’s going to happen in the second half of this year, as people start to see how well the Blackwell chips are selling, how good the gross margins are on those, and start thinking about what’s to come with the Rubin chips around the corner, I think we’ll start to see that euphoria reflected in a lofty go-forward price-earnings multiple, and if that happens, this thing can go to $6 trillion market cap,” Jackson said.

Jackson also argued that Nvidia has a sizable lead over its competition and will take advantage of that for years to come. Additionally, Jackson said that comparisons of Nvidia today to Cisco during the dot-com bubble are unfounded.

“This is not Cisco in the dot-com era. Back then Cisco’s go-forward p/e multiple got to a peak of something like 136x. Again, we’re below the mean for the last five years. So even though the stock has done so well, it is still relatively cheap compared to where it was trading in the past,” Jackson said.

Jackson isn’t the only one on Wall Street who is still bullish on the stock even when accounting for its massive run over the past year.

Constellation Research and Rosenblatt have a $200 price target for Nvidia stock, while Bank of America recently reiterated its $150 target.

While Nvidia’s long-term prospects remain bullish, according to Wall Street, that does not mean it is immune from sharp declines.

Shares of Nvidia wiped out more than $400 billion in market value earlier this week, with the stock staging a three-day correction of 16%.

Read the original article on Business Insider

Source link