Cecilie_Arcurs/E+ via Getty Images

Payment stocks could see a “nice rebound” in the second half of 2022, writes Mizuho Securities USA analyst Dan Dolev in a note to clients.

“Specifically, current expectations imply a positive inflection in the Payments two-year revenue growth stack as soon as 2Q22,” he said. Stock prices tend to follow such inflections, when looking at recent history.

Looking across, other tech subsectors, including Internet, Software or Semis, Mizuho’s research indicates that Payments may see a higher positive inflection than some other tech verticals.

There are many other factors that help determine Mizuho’s ratings and price targets. However, looking at the acceleration in the two-year stack, even when adjusting for their Russian exposure, Dolev estimates that Fleetcor Technologies (NYSE:FLT), Mastercard (NYSE:MA), Visa (NYSE:V), Wex (NYSE:WEX), Global Payments (NYSE:GPN), ADP (NASDAQ:ADP), Fidelity National Information (NYSE:FIS), and Fiserv (NASDAQ:FISV) should see the most acceleration.

Mizuho has Buy ratings on ADP (ADP), Fiserv (FISV), Fidelity National Information (FIS), Mastercard (MA), and Wex (WEX). It has Neutral ratings on Fleetcor (FLT), Global Payments (GPN), and Visa (V).

About a week ago, Bernstein analyst Harshita Rawat selected Visa (V) and Mastercard (MA) as the most likely to see positive revisions and “improvement in narrative.”

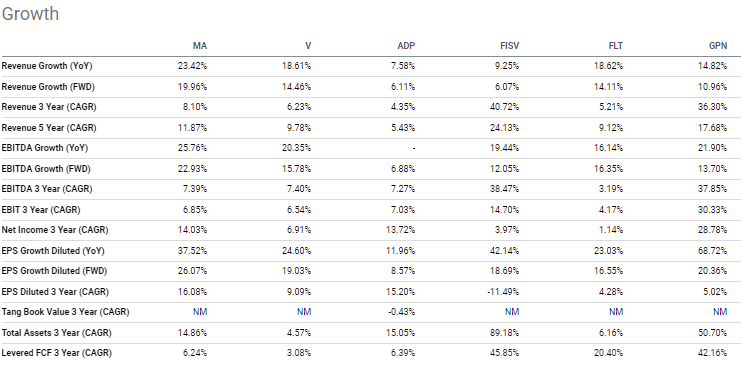

Compare growth metrics of some of the companies mentioned in this story here.

Previously (March 5), Visa (V), Mastercard (MA) suspend operations in Russia due to invasion of Ukraine

Source link