Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Private equity has scored a partial victory in its push to expand in the US legal market, after lobbyists softened legislation in California that threatened to disrupt liberalisation of law firm ownership rules.

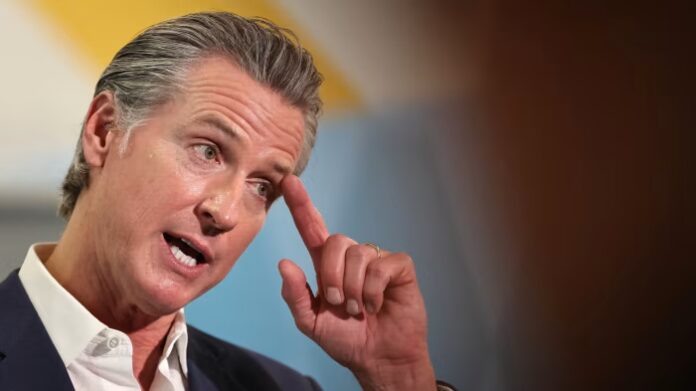

Attorneys in the country’s largest state will be allowed to partner on some legal work with investor-owned law firms under the terms of a law signed by Governor Gavin Newsom.

A previous version of the legislation would have banned all such work, in an attempt to freeze out new potential competitors from other states that allow non-lawyers to own law firms.

Neighbouring Arizona allows non-lawyers to own law firms under what it calls an “alternative business structure”, or ABS. More than 100 ABS firms now have licences in the state, many backed by private equity or venture capital, with ambitions to operate nationally through partnerships with lawyers in other states.

Most other states ban non-lawyers from investing in law firms, but Tennessee last month began consulting on whether it should introduce a similar system. Supporters say liberalisation of ownership rules will bring more competition and innovative, tech-enabled business models to the US legal market, bringing down costs and expanding access to justice.

The Big Four accounting firm KPMG also holds an Arizona ABS licence, from which it is building a national business offering legal services to corporate America.

ABS opponents, however, say the structure breaches long-standing conventions that protect legal advice from being contaminated by commercial considerations.

An effort to launch an ABS system in California ran into opposition from big law firms and was shut down by lawmakers in Sacramento in 2022.

The California legislation signed by Newsom on Friday originally aimed to keep ABS firms out of the state by banning local attorneys from co-counselling and fee sharing with any firm owned partly by non-lawyers.

After an intense lobbying effort by a group of ABS firms, the legislation was watered down so that it bans co-counselling only on contingent-fee cases such as personal injury claims. That was a particular focus of the bill’s sponsor, the Consumer Attorneys of California, a trade group for plaintiff-side trial lawyers who take on corporations and government agencies.

As amended, the law allows fee sharing as long as there is a dollar figure stated in the contract, as well as in a limited number of other circumstances.

“This is a move away from the outright prohibition on sharing fees and seems to be tailored to preventing ABS firms competing on contingency fee business,” said Austin Maloney, a partner at Hunton Andrews Kurth, which advises professional services firms on mergers and acquisitions.

The outcome was described as an improvement on the original bill by ABS firms that had backed the lobbying effort, albeit not a total victory.

“From a business perspective, I am comfortable with it,” said James Peters, North America managing director at Lawhive, a consumer law firm backed by Google Ventures that charges flat fees rather than billing by the hour.

“But I’m an access-to-justice advocate and from that perspective I’m unhappy.”

Source link