Kawisara Kaewprasert

Real estate stocks comfortably outperformed the broader markets in a month that saw the Wall Street’s benchmark index plunge to record lows and rebound to hover near all-time highs.

The Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) added 5.73% in August, while the S&P 500 climbed merely 2.28% comparatively.

“XLRE is finally all set to rebound after more than two years of underperformance triggered by the Fed’s tightening,” said Seeking Alpha analyst Komal Sarwar.

“Moreover, the share price underperformance in the past years combined with improving earnings growth outlook slashed its forward valuations significantly below a recent record high,” said Sarwar with a Buy rating.

The average SA analyst recommendation on the ETF changed to Buy this week, while the Quant rating remains a Buy.

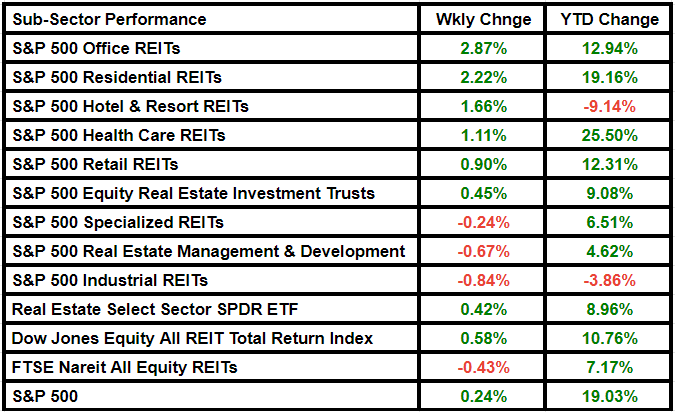

For the week ended August 30, XLRE gained 0.42% from last week to close at 43.55, while the S&P 500 advanced 0.24% to 5,648.38.

Dow Jones Equity All REIT Total Return Index added 0.58% in a week that saw the blue-chip Dow index touch a record high.

Meanwhile, the free-float adjusted, market capitalization-weighted index constituting all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property, FTSE Nareit All Equity REITs fell 0.43% on a weekly basis.

Sector News

- Wells Fargo upgraded EastGroup Properties (EGP) to Overweight from Equal Weight and downgraded Terreno Realty (TRNO) to Equal Weight from Overweight as the firm now favors supply-constrained markets and small size segments as demand eases in industrial real estate.

- Mortgage rates continued to tread downward on the back of an expected Federal Reserve rate cut, according to the Freddie Mac Primary Mortgage Survey. Mortgage applications rose by 0.5%.

- Homebuying in the U.S. will remain sluggish until a combination of stronger income growth and lower mortgage rates – closer to 6% – helps restore affordability in the housing market, Fannie Mae predicted.

Real Estate Select Sector SPDR ETF saw $71.46M of inflows this week, compared to outflows worth $29.17M a week prior. XLRE logged monthly inflows of $600.59M, compared to $15.94M of outflows in July, data solutions provider Vettafi said.

Retail traders are showing the highest level of optimism in two years, according to a Charles Schwab survey, with 56% reporting a bullish outlook for markets over the next three months, up from 46% in Q2.

The increased bullishness comes as inflation concerns eased in Q3 vs. Q2, while expectations for rate reductions by the Fed rose. Some 33% of survey respondents expect rate cuts of 50 basis points or more in the remainder of the year, up from 25% of those surveyed predicting such cuts last quarter.

Self-storage REIT Public Storage (PSA), health care REIT Ventas (VTR) and residential REIT Mid-America Apartment Communities (MAA) were the top-performing S&P 500 real estate stocks of August.

VTR, MAA and and office REIT BXP (BXP) led the weekly gainers. Here is a look at the XLRE subsector performances:

Source link