GoodLifeStudio/E+ via Getty Images

S&P 500 real stocks eked out small gains as the sector gears up for seismic changes amid an in-line inflation and higher retail sales data.

For the changes, the National Association of Realtors is dropping its standard commissions to agents as part of a deal to end antitrust lawsuits, potentially giving American home sellers more negotiating power over the fee structure when putting their houses on the market.

The changes will go into effect on Saturday after a court ruling found that requirements to post commissions reduced competition and kept rates artificially high.

While the changes could save sellers money, they could force buyers to come up with more to pay for the fees, or incentivize agents to focus on higher-priced homes.

XLRE, holding a 2.30% weightage in S&P 500, closed in green in two out of the five trading sessions.

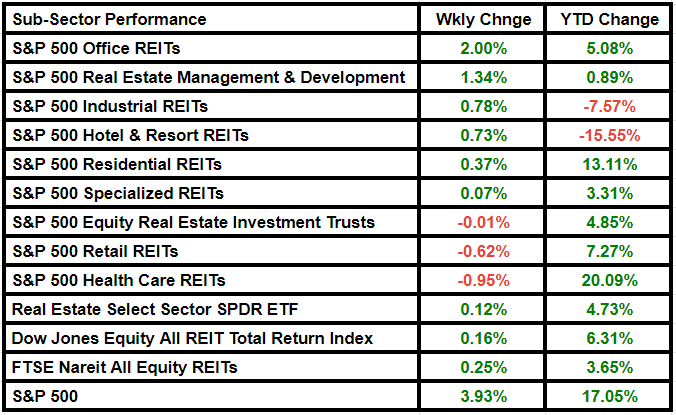

The Dow Jones Equity All REIT Total Return Index added 0.16% and FTSE Nareit All Equity REITs advanced 0.25%.

Sentiment

The Real Estate Select Sector SPDR Fund ETF saw net inflows worth $33.42M this week, compared to $407.84M in the prior week, data solutions provider Vettafi said.

Seeking Alpha’s Quant Rating system grades the ETF as Buy, with a score of 4.06 on a scale of 5. Quant gives the fund an A for Momentum, A for Expenses, C- for Dividends, D+ for Risk and A+ for Liquidity.

SA analysts rate the fund as Hold.

Investors’ optimism about the short-term outlook for the broader stock market increased this week, while bearish sentiment went down.

Analysts especially turned bullish on Camden Property Trust (CPT), Mid-America Apartment Communities (MAA) and Kimco Realty (KIM) and bearish on Prologis (PLD).

Notable movers

For the week, telecom tower REIT SBA Communications (SBAC), real estate services provider CBRE Group (CBRE) and residential REIT AvalonBay Communities (AVB) logged the most gains, while timber REIT Weyerhaeuser (WY) and health care REIT Ventas (VTR) were the biggest losers.

Office REITs and real estate management & development emerged as winners among subsectors. Health care REITs and retail REITs saw the most decline in value.

Wetouch Technology (WETH) and Wheeler Real Estate Investment Trust (WHLR) were the major gainers among the non-S&P 500 real estate stocks.

Source link