(Bloomberg) — Stocks extended gains after data showed US consumers tempered inflation expectations in late May, which bodes well for prospects of Federal Reserve rate cuts.

Most Read from Bloomberg

In a relatively quiet session, equities halted a two-day slide, with trading volume that was 25% below the average of the past month. Treasuries barely budged after Fed Governor Christopher Waller said the factors that lowered the so-called neutral rate may reverse. The US bond market was due to close early ahead of the Memorial Day holiday.

Consumers expect prices will climb at a 3.3% annual rate over the next year, down from the 3.5% that was expected earlier in the month, University of Michigan data showed Friday. In April, respondents expected year-ahead inflation of 3.2%.

“After further review, the consumer is not as pessimistic about the inflation trajectory,” said Jeff Roach at LPL Financial. “What we learned from this final estimate from UofM is consumer spending could slow, easing up inflationary pressures from the demand side of the economy.”

The S&P 500 hovered near 5,300, almost wiping out its weekly losses. The Nasdaq 100 rose almost 1% as Nvidia Corp. headed toward a fresh all-time high. Workday Inc. tumbled after the software company cut its forecast for subscription revenue.

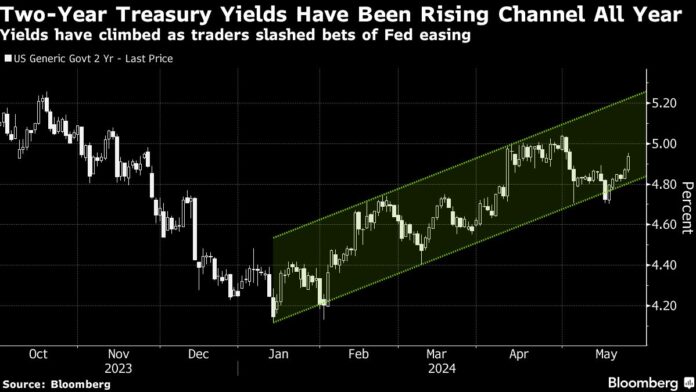

Treasury two-year yields were little changed at 4.94%. The dollar retreated. Bitcoin wavered. Oil and gold edged up. Copper headed for its biggest weekly loss since February.

The stock market can keep soaring to all-time highs even if the Fed forgoes interest-rate reductions this year as the economy and earnings are growing, according to Deutsche Bank AG’s Binky Chadha.

“It was another week dominated by ‘Fed anxiety’,” said Florian Ielpo at Lombard Odier Asset Management. “Let’s however remember that despite rising rates, company earnings appear resilient, subtly suggesting that the impact of what’s typically seen as positive economic news might be less straightforward.”

The rally in global equity markets is at risk of overheating, according to Bank of America Corp. strategist Michael Hartnett.

The bank’s so-called global breadth rule shows that about 71% of equity indexes are trading above both their 50- and 200-day moving averages. A reading above 88% would trigger a contrarian sell signal, he said.

Corporate Highlights:

-

Elon Musk’s SpaceX has initiated discussions about selling existing shares at a price that could value the closely held company at roughly $200 billion, according to people familiar with the matter.

-

Eli Lilly & Co. will spend $5.3 billion to boost production of a key ingredient in its weight-loss and diabetes shots after the treatments’ explosive popularity led to shortages.

-

Novo Nordisk A/S’s blockbuster diabetes drug Ozempic cut patients’ risk of dying in a kidney-disease study, the latest research pointing to the medicine’s usefulness in a constellation of disorders.

-

Intuit Inc. reported losing 1 million customers who use its TurboTax service for free, stoking concerns about demand for the software.

-

Bayer AG Chief Executive Officer Bill Anderson said the wave of lawsuits over its Roundup weedkiller is an “existential” threat to the company and farmers, ratcheting up the stakes as it considers a controversial legal maneuver.

Some market moves:

Stocks

-

The S&P 500 rose 0.5% as of 10:33 a.m. New York time

-

The Nasdaq 100 rose 0.8%

-

The Dow Jones Industrial Average rose 0.1%

-

The Stoxx Europe 600 fell 0.3%

-

The MSCI World Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.3% to $1.0849

-

The British pound rose 0.2% to $1.2728

-

The Japanese yen was little changed at 157.02 per dollar

Cryptocurrencies

-

Bitcoin rose 0.2% to $67,870.35

-

Ether fell 0.9% to $3,721.6

Bonds

-

The yield on 10-year Treasuries was little changed at 4.47%

-

Germany’s 10-year yield was little changed at 2.59%

-

Britain’s 10-year yield was little changed at 4.26%

Commodities

-

West Texas Intermediate crude rose 0.8% to $77.52 a barrel

-

Spot gold rose 0.4% to $2,338.81 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alexandra Semenova and Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link