The rate-hike cycle to battle inflation was brutal for small-cap stocks in 2022. But it didn’t get much better for the next two years. Though the Russell 2000 index climbed, its relative strength vs. the S&P 500 left a lot to be desired.

But that changed this summer.

Small-Cap Stocks Start To Outperform

After a number of false starts and trends that didn’t last, we still looked at the iShares Russell 2000 ETF (IWM) with interest. Small-cap stocks have a history of outperforming the S&P 500 so we were looking for evidence that the underperformance drought was ending.

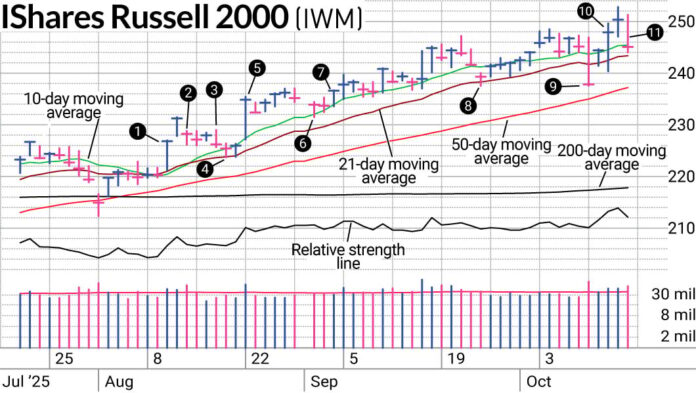

On Aug. 12, IWM finally broke out from its long cup-with-handle pattern (1). Not only did it break out, it outperformed strongly on the day. While the Nasdaq composite and S&P 500 were up 1.39% and 1.13%, respectively, the Russell 2000 and IWM shot up 2.97%.

We used a pullback a couple of days later as an entry on IBD’s SwingTrader product (2) but then exited quickly after not getting any traction (3). But again, the small-cap stocks weren’t forgotten. The next day saw support at the 21-day line and we used the upside reversal to get back into the IWM (4).

The persistence paid off. A couple days later saw a stunning 3.92% rise for the small-cap stocks ETF (5) giving us a chance to increase our weighting in the stock since we had a lower initial entry.

Trading Around A Core Position

When you have conviction in a position there are a couple of ways to give it preferential treatment. One is with a larger position size. The other is with an extended time horizon for the trade.

While SwingTrader does focus on short-term trades usually measured in days or weeks, a well-timed entry can extend that time frame up to a few months. But sticking with a larger position size over time can be more difficult. Even mild pullbacks hit hard when the size is larger. Trading around a core position can help reduce the drawdowns by scaling back either into strength or the first whiff of weakness.

A test of the 10-day line average along the way (6) led to some quick selling but then as the small-cap stocks ETF righted itself, we added the position back (7).

Some sells on weakness can be frustrating. Especially if there is an upside reversal on the day after shares are sold (8). It’s worth remembering that the sell often has the goal to reduce drawdowns. You’re protecting yourself from the cases when things get worse and sacrificing some gains for when the upside reversals come.

Is The Move In Small-Cap Stocks Over?

The weakness of last Friday put us all in cash and that included our IWM position (9). While our expectation following such moves is for sideways action as a base case, we have to be prepared to be wrong.

That’s why we reentered the small-cap ETF when it showed a sharp rebound (10). The relative strength was remarkable as IWM cleared last Friday’s high where most other indexes were still trading between the highs and lows of last Friday.

But the power didn’t last. As IWM took a hit on Thursday (11), we exited the position. While we’re open to being wrong on our assessment of choppiness on a short-term basis, we don’t want to fight that instinct when the market proves us right.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Mind The Gap! How To Manage Risk On Entries After A Gap-Up.

Regression Channel Lines And How To Use Them

Looking For The Next Stock Market Winner? Start With These 3 Steps

Read The Big Picture To Stay On The Right Side Of The Market