Here’s my conversation with Grok on the US bailout of Argentina.

Mish: What does the US risk with $40 billion bailout of Argentina?

Grok: The $40 billion bailout package for Argentina, announced by the Trump administration in October 2025, consists of a $20 billion direct currency swap from U.S. taxpayer funds (via the Exchange Stabilization Fund) and an additional $20 billion facilitated through private sector sources like banks and sovereign wealth funds. The aid aims to stabilize Argentina’s peso, support President Javier Milei’s fiscal reforms, and prevent economic unrest ahead of the country’s October 26 midterm elections. While framed as advancing U.S. geopolitical interests by bolstering a pro-market ally in Latin America, the package carries several significant risks for the United States, spanning financial, economic, political, and geopolitical dimensions.

Financial and Economic Risks

- Direct Loss of Taxpayer Funds: The $20 billion U.S.-funded portion exposes American taxpayers to substantial default risk. If Argentina fails to repay in dollars or if the peso devalues significantly, the U.S. Treasury could be left holding depreciated Argentine currency, leading to outright losses. This is heightened by Argentina’s history of repeated bailouts (over $50 billion from the IMF in recent years without sustainable recovery) and its current low foreign reserves (around $10 billion usable), making repayment uncertain. cfr.org +1 Unlike multilateral IMF loans that distribute risk across countries, this is a direct bilateral exposure, marking the largest such U.S. intervention since the 1995 Mexico bailout. cfr.org

- Opportunity Cost and Strain on U.S. Resources: The funds could divert from domestic priorities, such as affordable healthcare (where $20 billion exceeds the cost of stabilizing ACA premiums for a year) or aiding U.S. farmers facing their own crises. Critics argue this represents fiscal irresponsibility amid U.S. budget deficits and economic pressures like high interest rates. msnbc.com +1

- Harm to U.S. Farmers and Trade Competitiveness: By supporting Argentina’s economy, the bailout indirectly enables the removal of Argentine export tariffs on grains like soybeans, making their products cheaper and more competitive in global markets (e.g., China, which has boycotted U.S. soybeans amid Trump’s tariffs). This undercuts American farmers, who export $24 billion in soybeans annually and are already grappling with unsold crops, bankruptcies, labor shortages from deportations, and falling prices—potentially requiring an additional $10-14 billion U.S. bailout for domestic agriculture. cnn.com +1 This exacerbates trade war fallout, delaying Federal Reserve rate cuts and disrupting supply chains. cnn.com

- Forex and Market Exposure: The U.S. is actively buying pesos in foreign exchange markets to defend Argentina’s currency band, a rare move that could lead to immediate losses if the peso collapses post-elections or due to external pressures. cfr.org

Political Risks

- Domestic Backlash and Division: The package has drawn bipartisan criticism for contradicting Trump’s “America First” rhetoric, with funds going abroad while Americans face economic hardships. Republicans like Rep. Marjorie Taylor Greene have slammed it amid U.S. struggles, while Democrats, including House Minority Leader Hakeem Jeffries and Sen. Martin Heinrich, label it “America Last” and an opportunity to highlight GOP hypocrisy—e.g., bailing out a “right-wing wannabe dictator” abroad while blocking domestic aid like healthcare funding. thehill.com +2 This creates electoral vulnerabilities for the White House, especially if the bailout fails to deliver results. msnbc.com

- Public Perception of Favoritism: Tying aid to Milei’s electoral success and “good policy” is seen as U.S. election interference, alienating voters who view foreign bailouts unfavorably when no similar “rescue packages” exist for struggling U.S. families. msnbc.com +1

Geopolitical and Strategic Risks

- Precedent and Moral Hazard: This unilateral aid could encourage other countries to seek U.S. bailouts without genuine reforms, straining resources and setting a risky example for non-strategic partners like Argentina (not a treaty ally or systemic global threat). cfr.org It also risks moral hazard in IMF programs by providing unconditional support despite Argentina missing targets. cfr.org

- Damage to U.S. Credibility: If the bailout fails—given Argentina’s track record of bailout dependency and potential post-election peso collapse—it could undermine U.S. influence in international finance and Latin America, while failing to counter China’s regional sway (e.g., Argentina’s yuan swaps). cfr.org +1

- Regional Instability Ripple Effects: A failed stabilization could lead to commodity price volatility (Argentina is a major exporter), indirectly affecting U.S. economic interests, or escalate leftward political shifts in Latin America that the aid aims to prevent. politico.com +1

Overall, while the bailout may yield short-term geopolitical gains by supporting a U.S.-aligned leader, the risks outweigh potential benefits if Argentina’s reforms falter, potentially costing the U.S. billions in direct and indirect losses while fueling domestic political discord. cfr.org +1

Will Trump’s $20 Billion Backing Help Milei Change Argentina’s Fortunes?

A Council on Foreign Relations (CFR) by Brad Setser addresses the question Will Trump’s $20 Billion Backing Help Milei Change Argentina’s Fortunes?

Argentina has already gone through more than $50 billion in IMF funds. Despite the assurances of U.S. officials, there is skepticism that Argentina can achieve a different result with this currency swap.

The U.S. Treasury has announced that it is providing Argentina with a $20 billion currency swap, essentially an emergency credit line that constitutes the first large-scale rescue financed directly by the United States since the Bill Clinton administration provided Mexico with a $20 billion loan in 1995. Lending through the International Monetary Fund (IMF) has been much more common, as it poses far fewer risks to the United States.

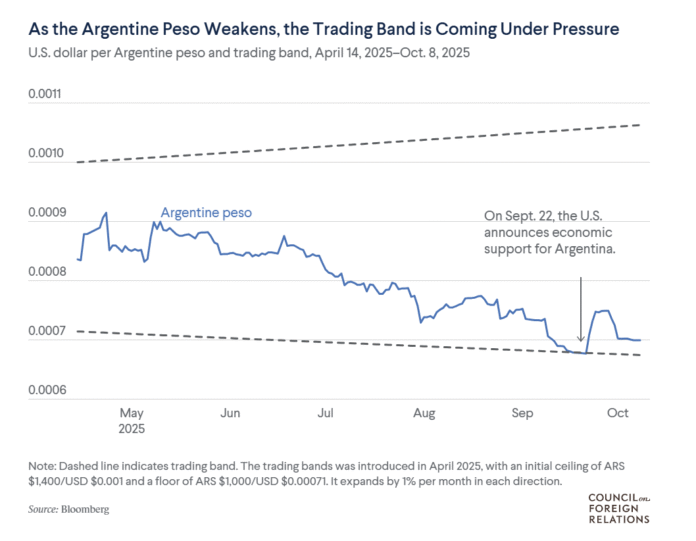

This unusual credit line—and even more unusual decision to use U.S. foreign exchange reserves to buy the Argentine peso last week—seeks to support the battered currency of South America’s third-largest economy, officials with President Donald Trump’s administration said. There is concern, however, that Argentina lacks a clear path to repaying both the United States and the already over-exposed IMF. Critics argue U.S. taxpayer dollars are being put at risk to provide Javier Milei, Argentina’s unorthodox and fiscally conservative president, a political lifeline weeks ahead of legislative elections on October 26.

Why does Argentina need help now?

The details of Argentina’s economic crisis are complex, but the bottom line is simple: Argentina needs help because it is running out of hard currency.

It has gotten into financial trouble this year even as its fiscal accounts improved because its external accounts have deteriorated. The current account—a measure of the broad trade balance that includes interest payments of foreign debt—moved into a deficit. The government has also wanted to keep its currency, the peso, relatively strong to help fight against inflation. But doing so required Argentina to dip into its foreign exchange reserves. When those reserves got to be critically low, Argentina sought—and obtained—the ability to borrow foreign exchange reserves from the United States.

Without an infusion of fresh foreign exchange reserves, Argentina would have been forced to abandon its currency band and allow a big fall in the peso, and it would have struggled to come up with the roughly $4 billion needed to make contractual payments on its external debt in early January.

How much foreign exchange does Argentina have left?

Argentina’s reported foreign exchange reserves are more than $30 billion, excluding modest gold reserves. But not all those reserves are available to prop up the peso in the foreign exchange market.

Of Argentina’s $33 billion in reported foreign exchange reserves, $13 billion are in Chinese yuan and cannot really be used without a new deal with China’s central bank. Several years ago, Argentina received an $18 billion currency “swap” line from the People’s Bank of China to bolster its reserves. Over time, Argentina was permitted to use $5 billion of those reserves—largely to repay the IMF—but the balance is still part of the country’s reported reserves.

Another $12 billion of Argentina’s reserves come from dollars put on deposit at the central bank by domestic banks. Those reserves are in dollars and could be used in a real emergency. But using the dollars set aside by the banks to pay their own depositors runs the risk of triggering a loss of confidence in the domestic banks, and the last thing Argentina needs now is a run on the banks. As a result, the usable reserves of the central bank are estimated to be as low as $10 billion. That is a very low number. And it is a surprisingly low sum considering that Argentina received a $14 billion loan from the IMF earlier this year.

Where is the U.S. Treasury getting the money it is lending to Argentina?

The U.S. Treasury has a pool of funds, known as the Exchange Stabilization Fund (ESF), that has been set aside to finance U.S. intervention in the foreign exchange market and to provide crisis lending. That pool of funds is always available to the secretary of the Treasury, even during a government shutdown. It was designed to be used in an emergency, such as the run on U.S. money market funds during the 2008 financial crisis.

The ESF has, according to its last report, around $22 billion that are immediately available, which is just enough to cover a $20 billion credit line. And the details matter here: Argentina might not be able to access all of the promised funds immediately.

However, there is another, more creative way the Treasury could raise dollars. The ESF holds around $170 billion of the IMF’s reserve currency, known as Special Drawing Rights (SDRs), and there are reports that the Treasury is considering making use of these funds. For the SDRs to come into play, the Treasury would first need to use them as a form of collateral to borrow dollars at the Federal Reserve. That is completely legal, but it also would be a novel move. Past rescue loans have been financed using the ESF’s standard hard currency reserves, not its SDRs.

Is this a bailout?

Yes, an emergency extension of credit to Argentina would meet all the standard definitions of a bailout.

Treasury Secretary Scott Bessent has tried to draw a distinction between a bailout and a swap, as the proposed $20 billion rescue is being structured as a swap with Argentina’s central bank, not a direct credit line to the government. In a swap, Argentina’s central bank receives dollars and credits the ESF account with an equal amount of pesos. But the United States doesn’t really want Argentina’s currency. It expects to be repaid in dollars, so it would be a massive failure if the swap was never unwound and the U.S. Treasury was left holding a slug of pesos. There is a reason why most countries don’t want to them as part of their international reserves.

It is important to note that these kinds of Treasury swaps are fundamentally different from those done by the Federal Reserve with other central banks. The Fed’s liquidity swaps are intended to allow the central banks of the other large, advanced economies to act as dollar lenders of last resort to their own banks. The ESF swaps are designed to help troubled emerging economies make payments and finance intervention in the foreign currency market.

The United States has also taken the unusual step of directly buying pesos in the foreign exchange market. That isn’t technically a bailout, which normally describes emergency lending, but it is in fact much riskier than just lending Argentina money because the ESF stands to lose money if the peso falls. This is the first time the U.S. has intervened in the foreign exchange market since Japan’s 2011 earthquake, and the first time in a very long time that the U.S. has bought the currency of an emerging economy.

Why is the Treasury taking these risks?

That is a good question. Argentina isn’t a U.S. treaty ally or on any geopolitical fault line. Argentina’s financial troubles aren’t likely to trigger a “systemic” financial crisis either, as there is no sign that Argentina’s deteriorating finances have spilled over to other emerging and frontier markets. In fact, most other emerging markets have done well financially this year.

The Treasury’s argument is that the United States has an interest in the success of Milei’s agenda, as his commitment to the unfettered market is setting an important example for the rest of the region. That is debatable. Argentina’s commitment to tight fiscal policy is commendable and necessary given it doesn’t have access to international markets. But Buenos Aires did miss critical IMF program targets this summer and had to get a waiver to receive the second tranche of IMF funding earlier this year. The United States doesn’t typically reward a country that missed IMF targets with an unconditional credit line.

Bessent’s argument is that the trading band around the peso is only under pressure because of concerns that Milei may lose control of Argentina’s economic policy path after the October 26 legislative elections. His party performed poorly in a September election in Buenos Aires, Argentina’s biggest province, creating doubts about the political sustainability of his fiscal cuts and pro-market policies.

The counterargument is that the peso was under pressure well before the provincial election. Milei’s government has been drawing on its reserves all year, and the only reason why reported reserves haven’t fallen is that Argentina got a big cash infusion from the IMF. There are also other signs that the peso is now overvalued. Argentine tourists are spending heavily abroad, for example, and there are reports that Buenos Aires itself has become a very expensive city. Per the Buenos Aires Times in March, the city boasted the world’s second-most expensive Big Mac at $7, and Latin America’s priciest cup of coffee at $3.50.

As economist Paul Krugman notes, exchange rate-based disinflation programs have a long history of collapsing in Latin America. A strong currency helps lower inflation, but it also starves the economy of foreign exchange—and that shortage of foreign exchange eventually becomes a problem. The U.S. Treasury is betting this time will be different.

How will we know if U.S. intervention succeeded?

A successful financial rescue is one that is no longer needed. This plan will succeed if Argentina either doesn’t need to draw on its credit line, or if it quickly repays any dollars it borrows.

I suspect we will have a good idea whether this rescue is on its way to success by the end of the year. One signal would be a peso that naturally trades inside the current exchange rate band even after the upcoming election, with enough market demand for pesos that Argentina can start buying back a few dollars and rebuilding its reserves.

Conversely, a peso that trades right at the edge of the band is a problem, as it would imply that Argentina is selling more reserves, including those borrowed from the United States. Argentina has already gone through—across two right-leaning governments—more than $50 billion in IMF funds. It needs to show that the new $20 billion credit line from the United States will produce a different result.

Trump Says Argentina Bailout Depends on Milei’s Party Winning Elections

The Wall Street Journal reports Trump Says Argentina Bailout Depends on Milei’s Party Winning Elections

President Trump directly tied the $20 billion lifeline the U.S. is extending to Argentina to President Javier Milei’s success in the coming midterm elections.

“If he loses, we are not going to be generous with Argentina,” Trump said, sitting across a table at the White House from the visiting South American leader, who he also endorsed for re-election in 2027. “If he doesn’t win, we’re gone.”

Trump’s remarks came days after the U.S. said it purchased Argentine pesos and wrapped up the framework for a $20 billion currency swap with the cash-strapped country’s central bank in an effort to stabilize markets and shore up the economy. Argentina is holding a midterm congressional election Oct. 26 that is widely seen as a referendum on Milei’s policies.

Milei is hoping to increase support in Congress, where his Freedom Advances party currently has less than 15% of the seats, to advance his free-market overhaul. Trump didn’t specify what he would consider a “win” for Milei’s party in the legislative elections.

Is Bessent a Liar?

Yes.

This is a bailout, not just an ordinary swap.

Grok outlines financial risks, geopolitical risks, and economic risks.

If Milei loses, the US would take an immediate loss on the basis of Trump’s statement “If he doesn’t win, we’re gone.”

Of course, that assumes Trump would do what he said.

Related Posts

October 18, 2025: Trump Tiptoes Away from Reciprocal Tariffs with Many New Exemptions

Trump silently modifies tariff policy, brushing aside the trade war hawks.

October 18, 2025: Zero Progress on the Reducing the Deficit Despite Tariff Revenue

For fiscal year 2025, the deficit is $1.8 trillion, similar to 2024.

Source link