(Bloomberg) — Walmart Inc. is seeking to raise as much as $3.74 billion by selling its stake in Chinese e-commerce firm JD.com Inc., winding down an eight-year partnership that appears to be paying diminishing returns amid a challenging landscape for Chinese tech giants.

Most Read from Bloomberg

The US retailer is offering 144.5 million shares in a $24.85 to $25.85 price range, people familiar with the matter said. Morgan Stanley is the broker-dealer handling the offering, they added, asking not to be identified because the information is private. That’s a discount of as much as 11.8% to Tuesday’s close in the US, according to Bloomberg calculations.

JD.com’s Hong Kong-listed shares fell 11% at trading open on Wednesday, leading a broader selloff in Chinese e-commerce and tech stocks. Walmart is refining its strategy in the world’s second-largest economy, where its long-standing e-commerce partner is struggling along with traditional rivals Alibaba Group Holding Ltd. and Temu-owner PDD Holdings Inc.

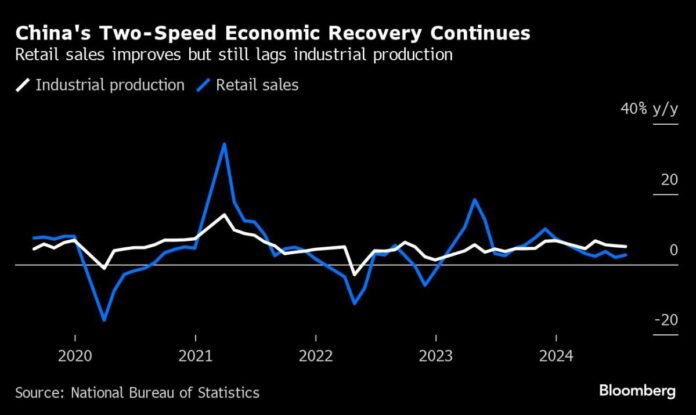

The US firm has built a mature e-commerce and delivery system in China for both Sam’s Club and its hypermarkets business and is focusing on its own offerings, a person familiar with the matter said, speaking on condition of anonymity. The deal also comes as a property crisis, market volatility and uncertain job prospects take a toll on Chinese consumption.

“I expect Walmart will be disappointed with the horse they backed,” said Mark Tanner, managing director at marketing agency China Skinny. “It doesn’t feel like the original ambitions have quite panned out as planned at the time of acquisition.”

Representatives for Walmart, JD.com and Morgan Stanley didn’t immediately respond to Bloomberg’s requests for comment. Cailian reported Wednesday that Walmart said the decision to reduce its shareholding would allow it to focus on its own businesses in China and allocate funds to other priorities.

Walmart’s Sam’s Club franchise has been a bright light for the company, making it the only hypermarket chain to post sales growth last year among the top 5 players, according to China Chain Store & Franchise Association. In China, the unit offers premium goods with a membership model that’s now being copied by rivals, while the company’s other basic hypermarkets are struggling along with competitors.

Meanwhile, China’s biggest Internet firms are trying to reverse decline as economic uncertainty and consumers’ shifting shopping habits weigh on earnings. Last week, Alibaba — long a barometer for the industry — surprised investors when it revealed its main commerce business actually shrank in the June quarter.

JD.com’s June-quarter results beat expectations — even though revenue grew a mere 1.2%. That extended a string of single-digit quarters dating back to 2022, a period of malaise that’s halved its market value since the start of last year.

The Walmart-JD break also follows a pattern of online and offline retail businesses dissolving their partnerships, as earlier ambitions to seamlessly merge the physical and cyber consumer experiences failed to be realized. Earlier this year, Bloomberg reported that Alibaba is considering selling its InTime department store arm.

The share sale would mark the end of a partnership between the two companies that started when Walmart acquired a 5% stake in the Chinese company in 2016.

That deal also involved JD.com taking over Walmart’s Yihaodian online marketplace, which focused on selling groceries to higher-end female shoppers in major Chinese cities, the companies said then. Later that year, Walmart increased its holdings in JD.com to 10.8%.

–With assistance from Edwin Chan.

(Updates throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link