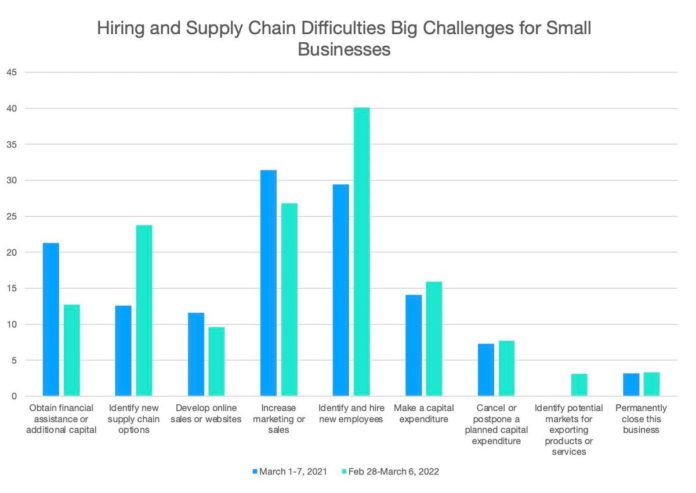

If there’s one chart that might encapsulate the broad experience of American small businesses over the past year, it’s this one.

Hiring and supply chains are two of small businesses’ biggest needs.

U.S. Census Bureau.

Taken from the Census Bureau’s Small Business Pulse Survey, this chart illustrates what small businesses cite as their top “future need.” It compares two time periods: early March 2021 (phase 4 of the survey) and early March 2022 (phase 8, with data through March 10th).

As shown, the share of small businesses citing “identify and hire new employees” as their top need leapt from 29% to 40%—a 36% increase. Likewise, there was a 89% increase in the share of small businesses pointing to “identify new supply chain options” as their top need.

Hire and Higher (Omicron Remix)

It’s getting to feel like a broken record. For many months now, we’ve seen hiring difficulties and rising costs top the charts of small business challenges. That redundancy, however, underscores the point: these issues haven’t gone away and they are unlikely to in coming months. Recent survey data from Census, the Federal Reserve’s Small Business Credit Survey, the National Federation of Independent Business, Thumbtack, and Alignable all carry the same message:

Small businesses are being squeezed by hiring difficulties and rising costs.

It may not get better soon. In a forthcoming report to be released next week, the Bipartisan Policy Center, in collaboration with Goldman Sachs 10,000 Small Businesses Voices, looks at these and related challenges. A column next week will explore that report and its findings. For now, let’s dig into these surveys.

Are Workers Out There?

Somewhere, perhaps. But they’re apparently not going to work at small businesses. Close to one-third (31%) of small businesses in the Census survey said they face difficulties hiring paid employees. That was an increase from 28% at the beginning of January.

In NFIB’s February Small Business Economic Trends, 48% of respondents reported job openings they couldn’t fill. That, said the report, was “far above” the 48-year historical average. Two-thirds (65%) of small businesses in Alignable’s survey said it was difficult for them to find and hire employees.

Hiring has been an unremitting challenge for months. Thumbtack’s survey, which was fielded in December, found that half of those trying to fill jobs had trouble doing so. The Small Business Credit Survey (SBCS), fielded by multiple Federal Reserve Banks last autumn, found that 60% of small businesses said “hiring or retaining qualified staff” was their top operational challenge.

We shouldn’t overlook modest improvements on the employment front. From mid-November through mid-January, the share of small businesses in the Census Pulse survey saying their number of employees had fallen in the previous week rose from 10% to 14%. Omicron weighed on payrolls. Now, the share has fallen back to 10%.

Will the labor crunch improve? Not unless other factors get better. Indeed Hiring Lab’s latest Job Search Survey, released earlier this week, looked at some of the reasons that jobless workers are not actively or urgently looking for work. The biggest reason for women? Child care. This is something that next week’s BPC report addresses.

Holding the Line on Prices?

Worker shortages are one reason that costs continue to rise for small businesses. In Alignable’s survey, 71% reported paying higher wages in February. That represented an 11-point increase in just one month. Rising labor costs are just one piece. The Bureau of Labor Statistics reported today that overall inflation is now at the highest year-over-year pace since early 1982.

This was not news to small businesses. Last year at this time, just two percent of respondents in the NFIB survey said inflation was their single biggest problem. In their latest report, 26% said it was, far outpacing other factors. Forty percent of Alignable respondents said inflation was their biggest concern—and nearly two-thirds (63%) said they’re passing higher costs along to customers. That was 12-point jump from January.

A net 68% of small business owners in the NFIB survey reported raising their average selling price. In Thumbtack’s survey (reporting data from December), 60% of respondents said they expected to raise prices in the next quarter. That is, they’re doing so right now.

Supply chain challenges are contributing to the inflation squeeze. Sixty percent of small businesses in the SBCS said supply chain issues were a top operational challenge. The chart at the top of this article, from Census Pulse, already underscored the jump in supply chain prominence for small businesses. A year ago, 29% of small businesses reported domestic supplier delays—today, 44% do.

Green Shoots of Spring

Continuing small business challenges shouldn’t totally overshadow some signs of optimism. Thumbtack’s survey found that 42% of home service professionals planned to invest in their businesses in the first quarter of 2022. Meaning, again, that they’re making those investments now.

Alignable’s survey was fielded more recently, during the second half of February and into early March. There, the waning impact of Omicron was evident. Just 27% of respondents said Covid-19 was “really impacting” their business. And 32% said the financial impact of the pandemic was declining. Both were significant improvements.

Most notable is the shrinking share of small businesses in the Census survey experiencing weekly revenue declines. From mid-December through mid-January, the share of small businesses experiencing a revenue decrease in the prior week had risen sharply from 23% to 34%. By the first week of March, that share had fallen to 21%.

Subsequent columns here will look at the new BPC report and dig into specific areas, including access to capital and government contracting.

Source link