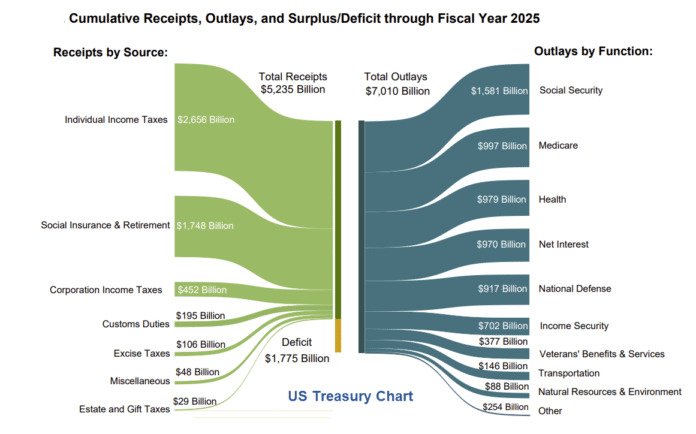

For fiscal year 2025, the deficit is $1.8 trillion, similar to 2024.

Please note the US Treasury Confirms $1.8 Trillion Deficit in FY 2025

The United States borrowed $1.8 trillion in Fiscal Year (FY) 2025 according to the latest Monthly Treasury Statement from the Treasury Department. This deficit is similar to last year’s, despite an additional $118 billion of tariff revenue and roughly $200 billion of lower deficits from recorded changes in the expected future cost of the student loan portfolio.

The monthly statement showed a surplus of $198 billion in the month of September – $118 billion more than the surplus logged in September of 2024. Roughly $130 billion of this surplus represents one-time savings from reforms that reduce the expected cost of the student loan portfolio. Another roughly $88 billion represents a timing shift of some payments due in September to August, as September 1 fell on a weekend. Without the one-time savings and timing shift, the government would have posted a modest deficit in September 2025.

The Treasury Department also showed that interest on the national debt continues to be one of the largest line-items in the federal budget – larger than defense spending and behind just Medicare and Social Security spending.

The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

The federal government continues to borrow $5 billion per day. Despite significant tariff revenue and large one-time student loan savings, our deficit is just as large as last year’s and shows no sign of decline.

Driving home the message that Washington has traded fiscal responsibility for total dysfunction, these deficit totals came to us while the federal government is in its second week of a shutdown. Our debt is headed for a record share of the economy and we’re posting nearly $2 trillion deficits outside of an emergency or recession – how do our leaders expect to deal with any of that when they can’t agree on keeping the lights on?

Here’s the Treasury Report.

Looking ahead, don’t forget to tack on Obamacare subsides because there will be a deal. Also factor in Trump’s “Golden Dome Defense Shield for America”.

And who the hell knows what Trump is going to get us into in Venezuela, Afghanistan, or Gaza.

Finally, none of these long-term budget projections factor in a recession, ever.

So, if you believe a $1.8 trillion deficit is likely as good as it gets for a while, you are thinking correctly.

Related Posts

May 21, 2025: How Much Will Trump’s “Golden Dome” Missile Defense Shield Cost?

Trump says $175 Billion. The CBO says $542 billion. Think much higher.

June 21, 2025: Record Deficits as Far as the Eye Can See and Trump Begs for More

Let’s investigate CBO deficit projections vs what actually happened.

August 14, 2025: US Debt Now Grows by $1 Trillion Every 150 Days

US national debt just topped $37 trillion and is growing fast.

October 17, 2025: U.S. Masses 10,000 Troops Near Venezuela, a Top Admiral Resigns

Are we going to invade? “We are certainly looking at land now,” said Trump.

October 16, 2025: Gold Surges $100 to New Record High Above $4,300 as Bond Yields Dive

Gold reiterates its message: Spending is out of control with no faith in the Fed.

And in the theater of the absurd, on October 13, 2025, I noted Fed Debates Whether a $6 Trillion Balance Sheet Is Ample

Source link